XRP is gaining attention with a classic bullish pattern, suggesting it might soon break above $3 and possibly rally by 20%, which could impact the altcoin market. After years of legal battles and skepticism, Ripple’s native token is making a strong comeback, trading well with increased buying from big investors and interest from institutions. XRP’s story is one of resilience, positioning itself for a significant run. Traders are watching closely to see if this momentum will continue or if there will be a sudden drop. The crypto community is excited, knowing that the next moves could make today’s investors either legends or cautionary tales.

XRP News Today

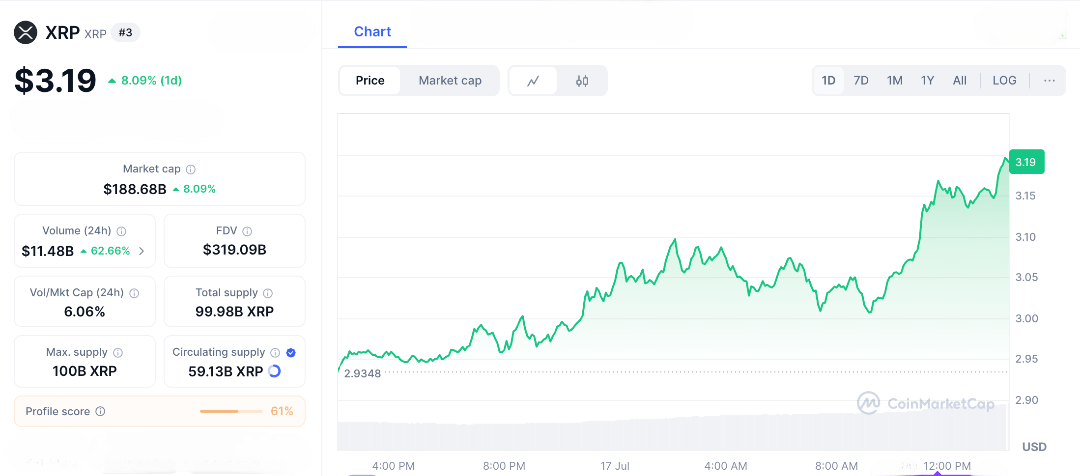

XRP has climbed about 8.09 % in the last 24 hours, holding firm near $3.19 with a market cap topping $188 billion. This isn’t just random price movement technical charts show a breakout from a descending resistance, with XRP moving inside an ascending channel backed by rising volume.

Traders are spotting a hidden Dollar index pattern that echoes previous rallies, hinting this breakout might be “hidden in plain sight.” Meanwhile, whales are piling in, accumulating billions of XRP tokens, while on-chain data reveals growing wallet numbers and optimism around potential ETF approvals.

Adding to the positive vibes, Ripple recently paid a $125 million SEC fine in cash no XRP liquidations needed removing a big overhang and clearing the path for XRP to fly higher. It’s a mix of strong technicals and legal closure fuelling today’s momentum.

Institutional Moves and Bullish Technicals Fuel Excitement

The story around XRP is getting even more interesting with Ripple pushing new frontiers. They’re introducing a metadata standard on the XRP Ledger to make tokens smarter, more secure, and easier to find setting the stage for expanded DeFi activity by the end of the year. Adding fuel to the fire, the ProShares Ultra XRP ETF just launched on NYSE Arca, offering leveraged exposure that could attract fresh institutional capital.

Technically, XRP looks strong, a long-standing double-bottom pattern dating back to 2017 has broken its neckline, with short-term price targets around $3.39 and even ambitious projections at $4.80 based on Fibonacci levels and historical price patterns. If XRP breaks past $3 cleanly, a 20% rise to about $3.66 seems within reach, supported by a bullish MACD crossover and an RSI that’s high but still sustainable.

Social hype is through the roof, with traders calling this “setup season,” and whales actively defending crucial support levels, making this rally feel solid and promising.

The Upside and the Risks

Every big story has its challenges, and XRP’s journey is no different. Right now, the RSI is sitting high at 96, signaling the token might be a bit overbought and could see some short-term pullbacks. Plus, if Bitcoin shifts gears, that rotation could limit how far XRP can climb in the near term. New competitors like Lightchain AI, launching soon, are promising cool tech that might steal some spotlight, adding to the pressure.

If investor sentiment sours maybe due to delays in the SEC vote or traders cashing out XRP could slip below its $2.84 support and possibly dip to around $2.65. But on the flip side, real-world wins are stacking up: RLUSD recently hit a $500 million market cap, and Dubai’s tokenization of real estate on the XRP Ledger shows growing adoption beyond speculation. This isn’t just hype it’s a powerful mix of technology, practical use cases, and growing momentum that’s got traders betting big on XRP as a breakout star.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.