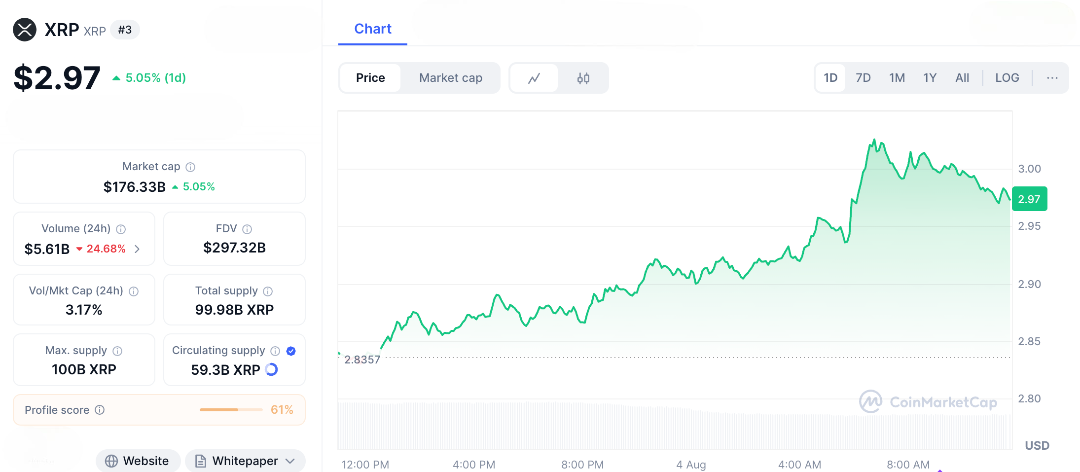

In the wild world of crypto where innovation meets regulation and dreams race against red tape XRP is once again making headlines. And this time, it’s not just noise. Imagine a digital asset built to move money across borders in seconds, while old-school systems are still buffering. That’s XRP. And after surviving legal storms and market dips, it’s back in the spotlight trading around $2.97, up 5% amid hype about a possible SEC green light and ETF rumours heating up.

So… could XRP really hit $10 in 2025? It’s not as far-fetched as it sounds. With growing global demand for fast, low-cost payments, Ripple’s expanding partnerships, and a community that refuses to give up, this underdog is gaining serious momentum. And let’s be honest every crypto trader loves a comeback story. This could be the one that turns “I should’ve bought” into “I’m glad I held.” If you’ve ever rooted for the long shot or believed in a second chance, XRP’s road to $10 might just be the next big chapter worth following and sharing.

XRP to $10? It All Starts With Regulatory Green Lights

XRP’s journey to $10 begins where it always has with clarity. For years, Ripple’s been locked in a legal battle with the SEC over whether XRP is a security. That uncertainty has kept major players on the sidelines. But now, the tide might be turning. Settlement talks are reportedly heating up, and analysts are hopeful that a resolution could finally classify XRP as a non-security for retail investors. Why does that matter? Because it could open the floodgates.

Just like Bitcoin’s ETF approval helped it blast past $100K, XRP ETFs from giants like Grayscale and BlackRock could be next. Some filings are already in motion and if approved, they could trigger billions in institutional inflows. Add that to a 2025 bull market, fuelled by friendlier policies and growing adoption, and you’ve got a perfect setup. XRP already moves billions in cross-border payments each year with lightning-fast speeds and rock-bottom fees. That kind of utility is hard to ignore. If regulators give the green light, XRP won’t just be back it could be heading for liftoff.

How Global Partnerships Could Propel XRP to $10

If there’s one thing powering XRP’s path to $10, it’s partnerships and Ripple has been building quietly but relentlessly. Its On-Demand Liquidity (ODL) service is now used by banks and payment providers in over 40 countries, with recent expansions across Asia and Latin America slashing cross-border transfer costs by up to 60%. In a world where global remittances exceed $800 billion a year, that’s no small edge especially when compared to SWIFT’s outdated and sluggish system.

As more institutions adopt XRP for speed and cost savings, transaction volumes rise, and with them, token burns increase, tightening supply. That’s a win-win for long-term holders. But the story doesn’t stop there. Ripple is also diving into tokenized assets, now offering support for things like real-world bonds and stablecoins. This creates a powerful flywheel effect more use cases lead to more adoption, which reduces available supply and pushes value upward. And if macro conditions shift say, the Fed cuts interest rates and global liquidity improves XRP could ride the same wave it did in 2017, when it shot up to $3.40 in a matter of weeks. This time, though, the climb might not be a fluke. It could be the beginning of something much bigger.

Momentum, Whales, and Market Winds

XRP’s climb to $10 isn’t just about utility it’s also about market momentum and investor confidence. Right now, on-chain data shows whales are buying the dip, adding millions of tokens to their wallets. That kind of accumulation usually hints at serious belief in a coming breakout. Technically, things look promising too. XRP is testing resistance around $2.97, and the RSI sits at 62, suggesting there’s still room to run before things get overheated.

Analysts are taking note. Outlets predict a move to $5 by mid-2025 as long as support at $2.90 holds. Others are even more bullish, seeing $10 as a realistic target if ETF approvals and adoption momentum continue to build. And let’s not forget the macro picture: with Bitcoin eyeing $200K in a post-halving run, altcoins like XRP often rally even harder, riding that wave with explosive multipliers. But it’s not all upside. SEC delays or a global economic slowdown could still weigh heavy, testing the patience of even the most loyal “XRP Army” members. For now, all eyes are on XRP’s next move. If the charts hold and sentiment stays strong, that $10 target might be more than just a dream it could be the breakout crypto comeback of the year.

The High-Stakes Journey Worth Watching

XRP’s path to $10 isn’t just another price prediction it’s shaping up to be one of crypto’s most compelling storylines. It’s got everything: legal drama, technological breakthroughs, and the kind of market momentum that could turn early believers into legends. As Ripple doubles down on building a tokenized financial future, imagine a world where your morning coffee in Tokyo is instantly paid from your account in New York, thanks to XRP. No borders, no delays.

For investors, it’s what you’d call an asymmetric bet. At $2.97, a move to $10 means a 233% return a rare opportunity in a space where risk is high, but so is reward. In the grand saga of crypto, where underdogs often defy the odds, XRP is once again stepping into the spotlight.

FAQs

- Did China Ban Crypto recently?

No, recent rumors recycle the 2021 ban; no new official policy has been announced by Chinese authorities. - What was the 2021 China crypto ban?

It prohibited financial institutions from crypto transactions, banned mining, and targeted exchanges to curb capital outflows. - Why are old ban rumors resurfacing?

Unverified social media posts and blogs amplify outdated news, possibly for engagement or market manipulation. - How do these rumors impact crypto markets?

They can cause temporary dips, like Bitcoin below $115,000, but markets often rebound as the claims prove baseless. - Is crypto activity ongoing in China?

Yes, underground trading via OTC desks and VPNs persists, while Hong Kong supports licensed exchanges under separate rules.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.