- Ethereum tokens HEMI, MERL, and ORDER posted the strongest weekly percentage gains.

- BNB Chain assets like STBL and AIC saw triple-digit growth alongside steady advances.

- Polygon and Optimism tokens showed synchronized increases, reinforcing Layer-2 momentum.

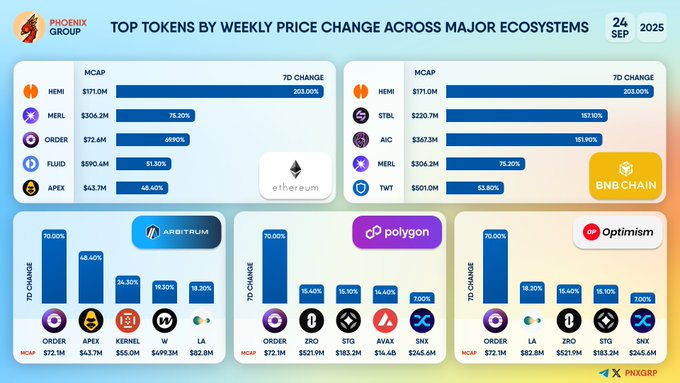

Crypto Weekly Price Change data for the week ending September 24, 2025, revealed sudden movements across Ethereum, BNB Chain, and multiple Layer-2 ecosystems. Figures from Phoenix Group highlighted several tokens that delivered triple-digit growth, while established names also maintained steady performance. The report showed how capital inflows concentrated around smaller-cap projects, signalling active participation across decentralized markets.

Ethereum Ecosystem Leads Crypto Weekly Price Change

The Ethereum network produced some of the highest gains in the weekly review. HEMI advanced 203%, pushing its market capitalization to $171.1 million. MERL recorded a 75.20% increase, reaching $306.2 million. ORDER stood out with a 689% surge, lifting its value to $72.6 million. Other contributors included FLUID, which climbed 61.30% to $590.4 million, and APEX, up 46.40% to $43.7 million.

TOP TOKENS BY WEEKLY PRICE CHANGE ACROSS MAJOR ECOSYSTEMS

#ETHEREUM $HEMI $MERL $ORDER $FLUID $APEX

#BNBCHAIN $HEMI $STBL $AIC $MERL $TWT

#ARBITRUM $ORDER $APEX $KERNEL $W $LA… pic.twitter.com/eA7M1J6wmY— PHOENIX – Crypto News & Analytics (@pnxgrp) September 24, 2025

Tokens tied to Arbitrum also registered notable progress. ORDER grew by 70.00% on the network, while APEX advanced by 48.40%. KERNEL, W, and LA posted smaller but steady weekly increases ranging from 24% to 33%. These results underscored Ethereum-linked environments as the key driver of market momentum during the period.

BNB Chain and Layer-2 Tokens Register Gains

BNB Chain assets followed a similar trend. HEMI repeated its 203% rise, while STBL grew 157.10%, reaching $820.7 million in market value. AIC gained 151.90% to $367.3 million, and MERL added 75.20%. TWT also advanced 53.80%, highlighting strong participation in BNB’s ecosystem.

Source: Phoenix Group

Layer-2 networks showed comparable results. On Polygon, ORDER climbed 70.00%, ZRO added 15.40%, STG gained 14.40%, AVAX advanced 12.90%, and SNX rose 7.00%. Optimism mirrored these movements, with ORDER again at 70.00%, followed by identical percentages for ZRO, STG, AVAX, and SNX. The alignment suggested synchronized growth across Layer-2 ecosystems.

Broader Outlook From Crypto Weekly Price Change

The Crypto Weekly Price Change report confirms that Ethereum and BNB Chain networks produced the strongest percentage gains, while Layer-2 platforms provided consistent support. ORDER emerged as the leading performer, with parallel gains across multiple networks. HEMI also delivered outsized advances, reinforcing its presence in both Ethereum and BNB Chain categories.

Market capitalization increases in both small-cap and mid-cap assets illustrate how liquidity has extended beyond isolated projects. The synchronized gains on Polygon and Optimism highlight the growing role of Layer-2 environments in shaping weekly performance trends.

As of September 24, 2025, the data shows investors focused attention on tokens delivering the largest swings in value. The figures underline how significant movements concentrated around ecosystems with both established market leaders and rapidly growing smaller-cap assets.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.