How CBDC Can Impact Global Financial System: Implementing CBDC

A CBDC, or Central Bank Digital Currency, refers to a digital form of a country’s fiat currency that is issued and regulated by the central bank. It is a digital representation of traditional money, such as banknotes and coins, but exists solely in electronic form. CBDCs are designed to be used as a medium of exchange, unit of account, and store of value, just like physical currencies.

Here are some key aspects of CBDCs:

1. Central Bank Issued: CBDCs are created and controlled by the central bank of a country, which has the authority to issue and regulate the currency. Unlike decentralized cryptocurrencies like Bitcoin, CBDCs are centralized in nature and operate within the existing financial system.

2. Legal Tender: CBDCs are typically recognized as legal tender, meaning they are accepted as a form of payment for goods and services and can be used to settle debts. They carry the same value and legal status as physical currencies issued by the central bank.

3. Digital Format: CBDCs exist in electronic form and are stored in digital wallets, which can be accessed through various devices like smartphones or computers. They can be transacted electronically, enabling instant and secure transfers between individuals, businesses, and financial institutions.

4. Backed by Central Bank: CBDCs are typically backed by the central bank’s reserves, just like traditional currencies. This means that the value of a CBDC is tied to the value of the underlying fiat currency. Users can convert their CBDCs into physical cash or other forms of money, and vice versa, based on the exchange rate determined by the central bank.

5. Different Variants: CBDCs can be classified into two main variants: retail CBDC and wholesale CBDC. Retail CBDC is aimed at the general public and can be used for everyday transactions, similar to physical cash. Wholesale CBDC, on the other hand, is intended for financial institutions and is used for interbank settlements and other large-scale transactions.

6. Advantages of CBDCs: CBDCs offer several potential benefits. They can enhance financial inclusion by providing access to digital payment services to those who are unbanked or underbanked. CBDCs can also improve transaction efficiency, reduce costs, and enable faster and more secure cross-border payments. Additionally, they can help combat illicit activities by providing a transparent and traceable digital currency.

7. Considerations and Challenges: The implementation of CBDCs involves various considerations and challenges. Privacy and security are crucial concerns, as the central bank needs to ensure the protection of personal data and guard against cyber threats. Interoperability with existing payment systems and the potential impact on monetary policy and financial stability are also important factors to be addressed.

It’s important to note that while several central banks around the world are exploring CBDCs and conducting research and pilot projects, the adoption and implementation of CBDCs vary across countries. The design, features, and timeline for the launch of CBDCs are subject to each central bank’s discretion and the specific requirements of their respective economies.

The new collaboration, called Project Icebreaker, involves the BIS Innovation Hub’s Nordic Centre, and it will test key functions and technical aspects of interlinking different domestic CBDC systems, according to a press statement.

— AlwaysOnTimeForever (@AonTb48) September 28, 2022

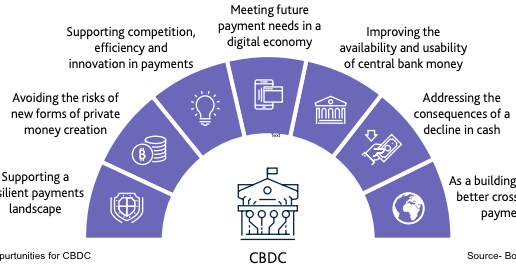

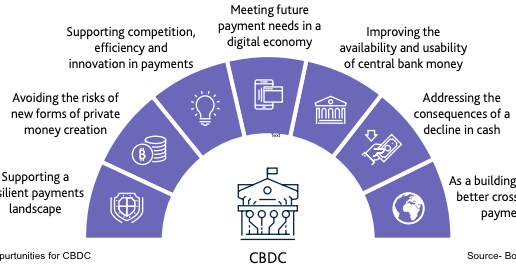

Why are central banks exploring CBDCs

Central banks are exploring CBDCs for several reasons. Here are some key factors driving their exploration:

1. Technological Advancements: The rapid advancement of technology, particularly blockchain and distributed ledger technology (DLT), has created new possibilities for the financial sector. Central banks are exploring CBDCs to leverage these technologies and create more efficient, secure, and inclusive payment systems. CBDCs can potentially streamline financial processes, reduce costs, and enhance the overall resilience of the monetary system.

2. Changing Payment Landscape: The payment landscape is evolving rapidly, with the rise of digital payment platforms, fintech innovations, and the increasing popularity of cryptocurrencies. Central banks recognize the need to adapt to these changes and maintain control over their monetary systems. By introducing CBDCs, they can provide a secure and regulated digital alternative to private cryptocurrencies while retaining authority over the currency.

3. Financial Inclusion: CBDCs have the potential to enhance financial inclusion by providing access to digital payment services for those who are unbanked or underbanked. Digital currencies can reach individuals who may not have access to traditional banking services, enabling them to participate more fully in the economy and facilitate financial transactions.

4. Payment System Efficiency: CBDCs can significantly improve the efficiency of payment systems by enabling instant and seamless transactions. Traditional cross-border payments can be time-consuming, costly, and prone to errors. CBDCs have the potential to simplify and accelerate these transactions, reducing settlement times and associated costs.

5. Monetary Policy Tools: Central banks see CBDCs as a means to refine their monetary policy tools and frameworks. The introduction of CBDCs can provide central banks with more direct control over the money supply and enhance their ability to implement and fine-tune monetary policy measures. CBDCs can potentially enable central banks to have real-time visibility into financial transactions, allowing for more effective monitoring and intervention when necessary.

6. Mitigating Risks and Challenges: By exploring CBDCs, central banks aim to address certain risks and challenges associated with the use of private cryptocurrencies. This includes concerns about financial stability, money laundering, terrorism financing, and consumer protection. CBDCs can provide a regulated and controlled digital currency option that mitigates these risks while maintaining the benefits of digital transactions.

7. International Competition: The exploration of CBDCs is also driven by the desire of central banks to stay competitive on the global stage. Several countries, including China, are making significant progress in developing and implementing CBDCs. Central banks want to ensure they are not left behind in the race for digital currencies, as CBDCs can have implications for international trade, cross-border payments, and financial dominance.

It’s important to note that while central banks are exploring CBDCs, they are proceeding with caution and conducting extensive research, pilot projects, and consultations with relevant stakeholders. The implementation of CBDCs requires careful consideration of various technical, legal, regulatory, and economic factors to ensure their effectiveness and compatibility with existing financial systems.

Also read: Trust should be the Critical Factor for CBDC Payments – SWIFT

Potential benefits and risks of CBDCs

CBDCs, or Central Bank Digital Currencies, offer several potential benefits and risks. Let’s delve into each category:

Potential Benefits of CBDCs:

1. Financial Inclusion: CBDCs have the potential to enhance financial inclusion by providing access to digital payment services to individuals who are unbanked or underbanked. This can help bridge the gap between traditional banking services and the financially underserved populations, empowering them to participate more fully in the economy.

2. Payment Efficiency: CBDCs can significantly improve payment efficiency by enabling instant and seamless transactions. Traditional payment systems can be time-consuming and costly, especially for cross-border transactions. CBDCs can streamline these processes, reducing settlement times, lowering transaction costs, and enhancing overall payment system efficiency.

3. Enhanced Security: CBDCs can offer enhanced security compared to physical cash or traditional electronic payment systems. By leveraging advanced cryptographic techniques and distributed ledger technology, CBDCs can provide secure and tamper-proof transactions, reducing the risk of counterfeit currency and fraud.

4. Monetary Policy Tools: CBDCs can provide central banks with more direct control over the money supply and enhance their ability to implement and fine-tune monetary policy measures. With CBDCs, central banks can have real-time visibility into financial transactions, allowing for more effective monitoring and intervention when necessary.

5. Reduced Costs: CBDCs can potentially reduce costs associated with cash management, such as printing, transportation, storage, and destruction of physical currency. Additionally, CBDCs can lower transaction costs by eliminating intermediaries in payment processes and enabling peer-to-peer transactions without the need for third-party payment processors.

Potential Risks of CBDCs:

1. Privacy Concerns: CBDCs raise concerns about privacy and data security. The digitization of currency means that transactions can be easily tracked and monitored. Striking a balance between ensuring transaction transparency for regulatory purposes and protecting individuals’ privacy rights is a challenge that needs to be addressed when designing CBDCs.

2. Cybersecurity Risks: CBDCs introduce new cybersecurity risks. Central banks would need robust security measures to safeguard against hacking, fraud, and other cyber threats. A breach in the CBDC system could have severe consequences, leading to financial instability and loss of trust in the currency.

3. Disintermediation: The introduction of CBDCs could potentially disrupt the traditional banking system by enabling individuals and businesses to hold accounts directly with the central bank. This disintermediation may impact commercial banks’ profitability and their ability to perform functions such as lending and financial intermediation.

4. Financial Stability: CBDCs can have implications for financial stability. In times of financial stress or crisis, there may be a risk of large-scale digital bank runs, as individuals might rapidly convert their bank deposits into CBDCs, potentially destabilizing the financial system. Central banks need to carefully manage these risks through appropriate design and regulation.

5. Technological Risks: Implementing CBDCs involves managing technological challenges. Distributed ledger technology, which is often considered for CBDC implementation, requires scalable and efficient systems to handle high transaction volumes. Additionally, there is a need for user-friendly interfaces, reliable network infrastructure, and protection against technological failures or outages.

6. Central Bank Responsibility: Central banks would assume significant responsibility with the introduction of CBDCs. They would need to effectively manage and regulate the currency, ensure the stability of its value, address potential market manipulation, and maintain public trust in the currency.

It is important to note that the actual benefits and risks of CBDCs may vary depending on the design, implementation, and regulatory framework adopted by each central bank. Thorough research, careful planning, and stakeholder engagement are crucial to maximize the benefits and mitigate the risks associated with CBDCs.

Impact of CBDC on monetary policy

The introduction of a Central Bank Digital Currency (CBDC) can have a significant impact on monetary policy. Here are some key aspects to consider:

1. Enhanced Policy Tools: CBDCs provide central banks with new and more direct policy tools. By having real-time visibility into financial transactions, central banks can gain better insights into the economy, monitor money flows, and respond more effectively to changes in economic conditions. This can lead to more precise and targeted monetary policy decisions.

2. Improved Transmission Mechanism: CBDCs can enhance the transmission mechanism of monetary policy. Traditional monetary policy measures rely on the banking system to transmit policy changes to the broader economy. With CBDCs, central banks have the ability to directly influence the behavior of households and businesses, bypassing intermediaries. This can potentially result in faster and more effective transmission of policy changes.

3. Interest Rate Management: CBDCs can offer central banks more flexibility in managing interest rates. With CBDCs, central banks can potentially implement negative interest rates more easily, as they have direct control over the digital currency and can impose charges on CBDC holdings. This can incentivize spending and discourage hoarding of funds during economic downturns.

4. Financial Stability Considerations: CBDCs introduce new considerations for financial stability. Central banks need to carefully manage potential risks associated with CBDCs, such as digital bank runs and the stability of commercial banks’ funding. These considerations may require the central bank to adjust monetary policy tools to address systemic risks and maintain financial stability.

5. Interaction with Commercial Banks: The introduction of CBDCs raises questions about the relationship between central banks and commercial banks. CBDCs may impact the deposit base and funding structure of commercial banks, potentially affecting their lending capacity. Central banks would need to carefully assess and manage these dynamics to ensure a stable and well-functioning banking system.

6. Data and Analysis: CBDCs generate a wealth of data that can provide valuable insights for monetary policy analysis. Central banks can leverage this data to enhance their understanding of economic trends, consumer behavior, and the effectiveness of policy measures. This can lead to more data-driven and evidence-based monetary policy decision-making.

7. Policy Implementation Efficiency: CBDCs can enhance the efficiency of policy implementation. Central banks can use CBDCs to distribute targeted stimulus measures directly to individuals and businesses during times of economic crisis. This can expedite the impact of policy measures and reduce implementation lags, improving the overall effectiveness of monetary policy.

8. International Implications: CBDCs may have implications for international monetary policy and exchange rate regimes. The adoption of CBDCs by multiple countries could impact the balance of reserve currencies and international payment systems. Central banks would need to consider the potential impact on cross-border transactions, capital flows, and coordination with other central banks.

It is important to note that the impact of CBDCs on monetary policy will depend on the specific design, implementation, and regulatory framework chosen by each central bank. Careful analysis, experimentation, and coordination with other policy areas are necessary to ensure that CBDCs enhance the effectiveness and stability of monetary policy.

Also read: Top 10 Ways CBDC Will Boost Cryptocurrency Market In 2023

Impact of CBDC on financial stability

The introduction of a Central Bank Digital Currency (CBDC) can have a significant impact on financial stability. Here are some key considerations regarding its impact:

1. Enhanced Payment System Stability: CBDCs can contribute to financial stability by improving the stability and resilience of the payment system. The digitization of currency reduces reliance on physical cash, which can be subject to operational disruptions or counterfeiting risks. CBDCs, with their secure and decentralized nature, can minimize these risks, ensuring smooth and efficient payment transactions even in times of crisis.

2. Reduced Systemic Risk: CBDCs can help reduce systemic risks in the financial system. By providing a digital alternative to privately issued cryptocurrencies, CBDCs can mitigate the risks associated with unregulated digital currencies. This includes concerns about money laundering, terrorism financing, fraud, and other illicit activities that can undermine financial stability.

3. Enhanced Financial Inclusion: CBDCs can promote financial stability by fostering greater financial inclusion. By providing a digital payment option accessible to individuals who are unbanked or underbanked, CBDCs enable broader participation in the formal financial system. This can reduce the reliance on informal and potentially unstable financial channels, contributing to overall financial stability.

4. Liquidity Provision: CBDCs can enhance the liquidity provision in the financial system. In times of stress or liquidity shortages, central banks can directly provide liquidity to banks and other financial institutions through CBDCs. This can help mitigate liquidity risks, ensure the stability of the banking system, and prevent potential contagion effects that can lead to financial instability.

5. Safeguarding Stability of Commercial Banks: The introduction of CBDCs raises considerations regarding the stability of commercial banks. CBDCs can potentially impact the deposit base and funding structure of commercial banks, potentially affecting their lending capacity and profitability. Central banks need to carefully manage this impact to ensure the stability and soundness of the banking system.

6. Potential Disintermediation Risks: CBDCs may introduce disintermediation risks, particularly if individuals and businesses prefer holding CBDCs directly with the central bank rather than in commercial bank accounts. This can impact the traditional banking system’s ability to perform key functions such as lending and financial intermediation. Central banks need to carefully assess and manage these risks to maintain a well-functioning and stable financial system.

7. Cybersecurity and Operational Risks: The introduction of CBDCs introduces new cybersecurity and operational risks. Central banks need to establish robust security measures to protect against hacking, fraud, and other cyber threats. Additionally, operational readiness is crucial to ensure the uninterrupted functioning of the CBDC system, as any disruptions could have systemic implications for financial stability.

8. Interplay with Monetary Policy: CBDCs can have implications for monetary policy and its impact on financial stability. The design and implementation of CBDCs should consider the potential effects on interest rates, money supply, and the transmission mechanism of monetary policy. Central banks need to carefully manage these dynamics to ensure the stability and effectiveness of monetary policy.

It is important to note that the impact of CBDCs on financial stability will depend on various factors, including the specific design, regulatory framework, and the broader financial ecosystem in which they are implemented. Thorough analysis, stress testing, and coordination with other policy areas are necessary to mitigate risks and ensure that CBDCs contribute to overall financial stability.

Impact of CBDC on international trade

The introduction of a Central Bank Digital Currency (CBDC) can have various impacts on international trade. Here are some key considerations regarding its impact:

1. Cross-Border Payments: CBDCs have the potential to streamline cross-border payments, making them faster, cheaper, and more efficient. Currently, cross-border transactions involve multiple intermediaries, complex settlement processes, and high fees. CBDCs can simplify these transactions by enabling direct and peer-to-peer transfers between parties, reducing the need for intermediaries and associated costs.

2. Payment Efficiency: CBDCs can enhance the efficiency of international trade by providing a secure and digital payment method. The digitization of currency eliminates the need for physical cash and traditional banking intermediaries, facilitating instant settlement and reducing transactional friction. This can contribute to faster trade flows, improved liquidity, and reduced settlement risks.

3. Reduced Foreign Exchange Risk: CBDCs can potentially mitigate foreign exchange risks for international traders. With CBDCs, transactions can be settled in the digital currency itself, reducing the need for currency conversions and exposure to exchange rate fluctuations. This can simplify international trade, eliminate foreign exchange costs, and enhance certainty in cross-border transactions.

4. Financial Inclusion in Trade: CBDCs can promote financial inclusion in international trade by providing access to digital payment services for individuals and businesses that may not have access to traditional banking systems. This can empower smaller businesses and individuals in emerging economies to participate more fully in global trade, reducing barriers to entry and fostering economic growth.

5. Trade Monitoring and Compliance: CBDCs can enhance trade monitoring and compliance efforts. The digital nature of CBDC transactions allows for better traceability and transparency, enabling authorities to monitor cross-border trade flows more effectively. This can help combat illicit activities such as money laundering, terrorism financing, and trade-based fraud, contributing to a more secure and compliant trading environment.

6. Impact on Exchange Rates: The introduction of CBDCs may have implications for exchange rates and currency dynamics. The adoption of CBDCs by multiple countries could impact the balance of reserve currencies and potentially alter the global currency landscape. Central banks would need to carefully manage the introduction of CBDCs to mitigate any destabilizing effects on exchange rates and international trade competitiveness.

7. Digital Trade Platforms: CBDCs can facilitate the development of digital trade platforms. By integrating CBDCs with digital trade platforms, trade transactions can be conducted seamlessly, with instant settlement and automated trade finance processes. This can lead to the emergence of new digital trade ecosystems, enabling businesses to engage in global trade more efficiently.

8. Geopolitical Implications: CBDCs can have geopolitical implications in international trade. The adoption of CBDCs by certain countries may influence trade relationships and alliances, as well as impact the dominance of existing reserve currencies. This could lead to shifts in economic power and potentially reshape the global trade landscape.

It is important to note that the impact of CBDCs on international trade will depend on various factors, including the adoption rates, interoperability between CBDCs, regulatory frameworks, and the willingness of market participants to embrace these digital currencies. Thorough analysis, international cooperation, and coordination among central banks are necessary to ensure that CBDCs contribute positively to international trade.

Top 10 Challenges in implementing CBDC

Central bank digital currencies (CBDCs) are digital versions of fiat currency that are issued and regulated by a central bank. CBDCs have the potential to revolutionize the way we pay for goods and services, but they also pose a number of challenges for central banks and policymakers.

Here are the top 10 challenges in implementing CBDCs:

- Designing a secure and scalable system. CBDCs must be designed to be secure and scalable enough to handle large volumes of transactions. This is a major challenge, as traditional payment systems are not designed to handle the volume of transactions that a CBDC would generate.

- Protecting user privacy. CBDCs must be designed to protect user privacy. This is a challenge, as CBDCs are digital currencies that are stored on a central ledger. This means that central banks would have access to a vast amount of data about their citizens’ spending habits.

- Monetary policy. CBDCs could have a significant impact on monetary policy. For example, if CBDCs are widely adopted, it could make it more difficult for central banks to control inflation.

- Financial stability. CBDCs could pose a risk to financial stability. For example, if CBDCs are used to replace bank deposits, it could reduce the amount of money that banks have available to lend. This could lead to a credit crunch and a recession.

- Cross-border payments. CBDCs could make cross-border payments cheaper and faster. This is because CBDCs would not be subject to the same fees and regulations as traditional payment methods.

- International cooperation. The implementation of CBDCs will require international cooperation. This is because CBDCs could have a significant impact on the global financial system.

- Technology adoption. The success of CBDCs will depend on the willingness of the public to adopt them. This is because CBDCs are a new technology and people may be reluctant to switch from traditional payment methods.

- Regulation. CBDCs will need to be regulated to protect consumers and prevent fraud. This is a complex task, as CBDCs are a new technology and there is no existing regulatory framework to follow.

- Cost. The implementation of CBDCs will be costly. This is because central banks will need to invest in new technology and infrastructure to support CBDCs.

- Timing. It is unclear when CBDCs will be implemented. This is because central banks are still in the early stages of research and development.

These are just some of the challenges that central banks and policymakers will face in implementing CBDCs. The successful implementation of CBDCs will require careful planning and coordination.