How To Invest In Crypto Bull Market As A New Investor

The term “bull market” is commonly used to describe a financial market characterized by rising prices and optimistic investor sentiment. When it comes to the cryptocurrency market, a bull market refers to a sustained period of upward price movement and increased trading volume for cryptocurrencies. During a bull market, investors are generally confident in the future prospects of cryptocurrencies and are willing to buy and hold them in anticipation of further price appreciation.

There are several factors that can contribute to the emergence and sustenance of a bull market in cryptocurrencies. These factors can vary in significance and influence from one market cycle to another, but some common elements include:

1. Positive Market Sentiment: Bull markets often begin with positive market sentiment, driven by factors such as favorable regulatory developments, mainstream adoption of cryptocurrencies, or positive news coverage. As more people become aware of cryptocurrencies and perceive them as a viable investment option, demand increases, leading to higher prices.

2. Market Adoption and Infrastructure: The growth of a bull market in cryptocurrencies is often supported by increased adoption and infrastructure development. When more merchants accept cryptocurrencies as a form of payment and more financial institutions offer cryptocurrency-related services, it reinforces the belief in their long-term viability and attracts more investors to the market.

3. Speculative Investing: Cryptocurrencies are known for their high volatility, which attracts speculative investors looking to profit from price fluctuations. During a bull market, speculative investing can amplify price movements as more investors enter the market with the expectation of significant returns. This increased demand can push prices higher, creating a positive feedback loop.

4. Institutional Involvement: The involvement of institutional investors can have a significant impact on the cryptocurrency market. When large financial institutions, such as hedge funds or asset managers, enter the market and allocate capital to cryptocurrencies, it not only increases liquidity but also lends credibility to the asset class. Institutional involvement is often seen as a positive signal by retail investors, contributing to a bull market.

5. FOMO (Fear of Missing Out): Human psychology plays a crucial role in market dynamics, and the fear of missing out (FOMO) can drive the prices of cryptocurrencies higher during a bull market. As prices rise, investors who have been on the sidelines may be tempted to enter the market to avoid missing out on potential gains. This influx of new investors can further drive prices up.

6. Positive Feedback Loop: A bull market in cryptocurrencies often creates a positive feedback loop. Rising prices attract more attention, which generates media coverage and attracts new investors. As prices continue to climb, existing investors see their investments appreciate, leading to further optimism and increased buying pressure.

It’s important to note that bull markets in cryptocurrencies are not without risks. The high volatility of the market means that prices can experience significant declines as well. Additionally, the absence of regulation in certain jurisdictions can create an environment prone to manipulation and fraud. Therefore, investors should exercise caution, conduct thorough research, and consider their risk tolerance before participating in the cryptocurrency market.

In conclusion, a bull market in cryptocurrency refers to a sustained period of rising prices and increased investor optimism. It is often driven by positive market sentiment, increased adoption and infrastructure development, speculative investing, institutional involvement, FOMO, and a positive feedback loop. While a bull market can present lucrative opportunities for investors, it’s crucial to remain mindful of the inherent risks and make informed investment decisions.

Also read: What is Bull Vs Bear Crypto Market. What’s the difference?

How to identify Bull market in cryptocurrency

Identifying a bull market in cryptocurrency can be challenging but there are several indicators and techniques that traders and investors use to assess the market conditions. While no single indicator can provide a foolproof confirmation of a bull market, combining multiple indicators and analyzing various factors can help in identifying the prevailing market sentiment. Here are some key methods and indicators used to identify a bull market in cryptocurrency:

1. Price Trend: One of the simplest ways to determine a bull market is by observing the price trend of cryptocurrencies. In a bull market, prices tend to consistently rise over an extended period, often forming higher highs and higher lows on the price chart. Traders may use technical analysis tools like moving averages, trendlines, and chart patterns to identify and confirm the upward price trend.

2. Trading Volume: Bull markets in cryptocurrencies are usually accompanied by increased trading volume. Higher trading volume indicates greater participation and interest from market participants, suggesting a growing demand for cryptocurrencies. Monitoring trading volume can help confirm the strength of a bull market and distinguish it from temporary price spikes or isolated rallies.

3. Market Sentiment and News: Market sentiment plays a crucial role in identifying a bull market. Positive news, such as regulatory developments, institutional investments, new partnerships, or widespread adoption of cryptocurrencies, can influence sentiment and contribute to a bull market. Traders and investors monitor news outlets, social media platforms, and cryptocurrency communities to gauge the overall sentiment and assess the prevailing market conditions.

4. Technical Indicators: Traders often employ various technical indicators to assess the strength of a bull market. Some commonly used indicators include the Moving Average Convergence Divergence (MACD), Relative Strength Index (RSI), and the Average Directional Index (ADX). These indicators can provide insights into the momentum, overbought or oversold conditions, and the strength of the prevailing trend in the cryptocurrency market.

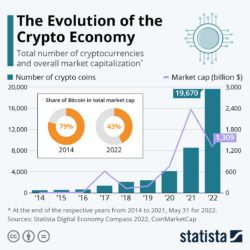

5. Market Capitalization: Market capitalization, which is calculated by multiplying the price of a cryptocurrency by its total supply, can be an indicator of a bull market. During a bull market, the overall market capitalization of cryptocurrencies tends to rise significantly as more capital flows into the market. Tracking the total market capitalization of the cryptocurrency market can provide insights into the overall health and trend of the market.

6. Investor Behavior and Sentiment: Monitoring investor behavior and sentiment can offer valuable insights into market trends. During a bull market, investors tend to exhibit increased optimism, enthusiasm, and a higher appetite for risk. Social media sentiment analysis, surveys, and sentiment indicators can help gauge the overall sentiment of market participants and identify shifts in investor behavior.

7. Long-Term Trend Analysis: Analyzing long-term price charts and trends can help identify a bull market in cryptocurrencies. Examining historical data and observing whether the current price movement is part of a longer-term upward trend can provide valuable context and help confirm the presence of a bull market.

It’s important to note that identifying a bull market in cryptocurrencies is not an exact science, and false signals can occur. Markets can be volatile and subject to sudden reversals, so it’s crucial to exercise caution and consider multiple indicators and factors when assessing market conditions. Traders and investors should also consider risk management strategies and conduct thorough research before making any investment decisions.

Also read: Top 10 Crypto Friendly Banks For Big Cryptocurrencies In The Market

Different ways to invest in cryptocurrency

Investing in cryptocurrency offers various avenues for individuals to participate in the digital asset market. Here are different ways to invest in cryptocurrencies:

1. Buying and Holding: This is the most straightforward and common method of investing in cryptocurrencies. It involves purchasing cryptocurrencies, such as Bitcoin (BTC), Ethereum (ETH), or Litecoin (LTC), from a cryptocurrency exchange and holding them in a digital wallet. Investors believe in the long-term potential of the chosen cryptocurrencies and aim to benefit from price appreciation over time. Holding the assets requires managing the private keys or utilizing secure custody solutions.

2. Cryptocurrency Exchanges: Cryptocurrency exchanges are online platforms where individuals can buy, sell, and trade cryptocurrencies. Exchanges offer a wide range of cryptocurrencies and provide liquidity for investors. To invest through an exchange, users need to create an account, complete the verification process, and deposit funds into their account. They can then execute trades based on market prices and their investment strategy. It’s crucial to choose reputable and secure exchanges with robust security measures.

3. Cryptocurrency Funds: Cryptocurrency funds offer an alternative for investors who prefer a more diversified approach or want professional management of their investments. There are two main types of cryptocurrency funds: mutual funds and exchange-traded funds (ETFs). Mutual funds pool investors’ funds to invest in a portfolio of cryptocurrencies, managed by professional fund managers. ETFs, on the other hand, trade on traditional stock exchanges and track the performance of a cryptocurrency index or a basket of cryptocurrencies.

4. Initial Coin Offerings (ICOs) and Token Sales: ICOs and token sales provide an opportunity to invest in early-stage projects and startups within the cryptocurrency ecosystem. These projects issue their own native tokens or coins, which investors can purchase during the fundraising phase. It’s essential to conduct thorough research and due diligence before participating in ICOs, as they carry higher risks compared to established cryptocurrencies.

5. Cryptocurrency Mining: Mining involves verifying and validating transactions on a blockchain network and being rewarded with newly created cryptocurrencies. It requires specialized hardware and significant computational power. While mining can be profitable, it often requires substantial investment in mining equipment, electricity, and maintenance. Additionally, it’s important to consider the energy consumption and environmental impact of mining operations.

6. Peer-to-Peer Trading: Peer-to-peer (P2P) trading platforms enable individuals to directly buy and sell cryptocurrencies without the involvement of intermediaries like exchanges. P2P platforms connect buyers and sellers, allowing them to negotiate and execute trades. This method offers greater privacy and flexibility but requires careful consideration of counterparty risks and adherence to proper security practices.

7. Crypto-Related Stocks and Companies: Some traditional companies have exposure to cryptocurrencies through their operations or investments. Investors can explore publicly traded stocks of companies involved in cryptocurrency mining, blockchain technology development, or those that hold significant amounts of cryptocurrencies as part of their treasury. Investing in these stocks provides exposure to the cryptocurrency market indirectly through established companies.

8. Decentralized Finance (DeFi): DeFi refers to decentralized financial applications built on blockchain platforms that aim to provide traditional financial services without intermediaries. By investing in DeFi platforms, users can participate in various lending and borrowing protocols, liquidity pools, yield farming, and other decentralized financial instruments. However, DeFi investments come with their own set of risks, including smart contract vulnerabilities and regulatory uncertainties.

It’s important to note that investing in cryptocurrencies carries risks, including price volatility, regulatory uncertainties, cybersecurity threats, and market manipulation. Investors should conduct thorough research, understand their risk tolerance, and consider diversification strategies. Additionally, implementing proper security measures to protect digital assets, such as using hardware wallets and practicing good cybersecurity hygiene, is crucial when investing in cryptocurrencies.

Risks and Rewards of investing in cryptocurrency

Investing in cryptocurrency offers both potential rewards and inherent risks. Here’s a detailed explanation of the risks and rewards associated with investing in cryptocurrencies:

Rewards:

1. High Potential Returns: Cryptocurrencies have gained significant attention due to their potential for high returns. Some early investors in cryptocurrencies like Bitcoin or Ethereum have experienced substantial profits as the prices of these assets soared over time. Investing in cryptocurrencies during a bull market can lead to significant gains if the market continues to rise.

2. Portfolio Diversification: Cryptocurrencies provide an opportunity to diversify investment portfolios beyond traditional asset classes like stocks and bonds. Since cryptocurrencies have a relatively low correlation with traditional markets, adding them to a diversified portfolio may potentially reduce overall portfolio risk and enhance returns.

3. Innovation and Technological Advancements: The underlying technology of cryptocurrencies, blockchain, has the potential to revolutionize various industries. By investing in cryptocurrencies, individuals can participate in the growth and adoption of blockchain technology, which may lead to long-term rewards as new use cases and applications emerge.

4. Access to Global Markets: Cryptocurrencies operate on a decentralized global network, providing investors with the ability to access and participate in financial markets worldwide without the need for traditional intermediaries. This opens up opportunities for individuals who may face barriers to entry in traditional financial systems.

Risks:

1. Price Volatility: Cryptocurrencies are known for their price volatility. Prices can experience rapid and significant fluctuations within short periods, leading to substantial gains or losses. Volatility exposes investors to the risk of substantial portfolio value fluctuations and can be challenging to predict or manage effectively.

2. Regulatory and Legal Risks: The regulatory environment surrounding cryptocurrencies is still evolving in many jurisdictions. Changes in regulations or government actions can impact the legality, trading, and use of cryptocurrencies, potentially affecting their value and market liquidity. Regulatory uncertainties pose risks to investors, particularly in terms of compliance, taxation, and investor protection.

3. Security and Hacking Risks: Cryptocurrency investments are vulnerable to security risks and hacking attacks. Digital wallets, exchanges, and other cryptocurrency platforms have been targeted by hackers in the past, resulting in the loss of significant amounts of funds. Investors must employ robust security measures, such as using hardware wallets, two-factor authentication, and choosing reputable platforms, to mitigate these risks.

4. Market Manipulation and Fraud: Cryptocurrency markets are susceptible to market manipulation and fraudulent activities due to their relatively low liquidity and unregulated nature. Pump-and-dump schemes, fraudulent initial coin offerings (ICOs), and fake trading volumes can deceive investors and lead to financial losses. Thorough research and due diligence are essential to avoid falling victim to scams or fraudulent projects.

5. Lack of Fundamental Valuation: Unlike traditional assets, cryptocurrencies often lack clear fundamental valuation metrics. Determining the intrinsic value of a cryptocurrency can be challenging, as factors like utility, adoption, and market sentiment play significant roles in their pricing. This makes it difficult to assess the fair value of cryptocurrencies and adds uncertainty to investment decisions.

6. Liquidity Risk: Cryptocurrency markets, particularly for less popular or newly launched cryptocurrencies, may suffer from low liquidity. Limited liquidity can make it difficult to buy or sell significant amounts of cryptocurrencies at desired prices, potentially leading to slippage and affecting the execution of investment strategies.

7. Emotional Decision-making and Herd Mentality: The volatile nature of cryptocurrency markets can trigger emotional decision-making and herd mentality among investors. Fear, greed, and the fear of missing out (FOMO) can lead to impulsive investment decisions and irrational behavior. Emotional investing can amplify risks and lead to poor investment outcomes.

It’s crucial for investors to carefully assess and understand the risks associated with investing in cryptocurrencies. Building a diversified portfolio, conducting thorough research, staying informed about market developments, and adhering to risk management strategies can help mitigate risks and improve the potential for rewards. Additionally, consulting with financial professionals or advisors who specialize in cryptocurrencies can provide valuable guidance for making informed investment decisions.

Top 10 tips for successful investing in bull market

Here are 10 tips for successful investing in a crypto bull market:

- Do your research. Before you invest in any cryptocurrency, it’s important to do your research and understand the underlying technology, the team behind the project, and the market potential. There are a lot of scams out there, so it’s important to be careful.

- Start small. Don’t invest more than you can afford to lose. The cryptocurrency market is volatile, and prices can go up and down quickly. It’s important to start small and gradually increase your investment as you learn more about the market and become more comfortable with the risk.

- Diversify your portfolio. Don’t put all your eggs in one basket. Instead, diversify your portfolio by investing in a variety of cryptocurrencies. This will help to reduce your risk if one cryptocurrency performs poorly.

- Don’t panic sell. It’s natural to feel fear when the market is down. But it’s important to remember that the market is cyclical and prices will eventually go back up. Don’t panic sell and sell your investments at a loss.

- HODL. HODL stands for “hold on for dear life.” This is a popular strategy among cryptocurrency investors who believe that the long-term trend for cryptocurrencies is up. If you believe in the future of cryptocurrencies, then HODLing may be a good strategy for you.

- Take profits. Don’t be afraid to take profits when you’re up. It’s important to take some of your profits off the table so that you don’t lose everything if the market takes a downturn.

- Be patient. The cryptocurrency market is still in its early stages, and it’s important to be patient. Don’t expect to get rich quick. Instead, focus on the long-term and let your investments grow over time.

- Stay up-to-date on the latest news. The cryptocurrency market is constantly changing, so it’s important to stay up-to-date on the latest news. This will help you to make informed investment decisions.

- Use a reputable exchange. When you’re ready to start investing in cryptocurrencies, it’s important to use a reputable exchange. There are a lot of scams out there, so it’s important to do your research and choose an exchange that you trust.

- Have fun! Investing in cryptocurrencies can be a lot of fun. So don’t take it too seriously and enjoy the ride.

The cryptocurrency market is a volatile and unpredictable place, but it can also be a very rewarding one. By following these tips, you can increase your chances of success in the crypto bull market.

A lot of people ask me about #crypto on a day to day basis.

“Should I buy now?”

“Is it going down more?”

“Will there be another bull run”All the fear and panic, it’s palpable. But there’s one rule I’ve learned about crypto that always gets me through these times, here it is 👇…

— Lady of Crypto (@LadyofCrypto1) June 15, 2023