Top 10 Reasons Machine Learning In NFT Trading Is Important And Also Very Interesting

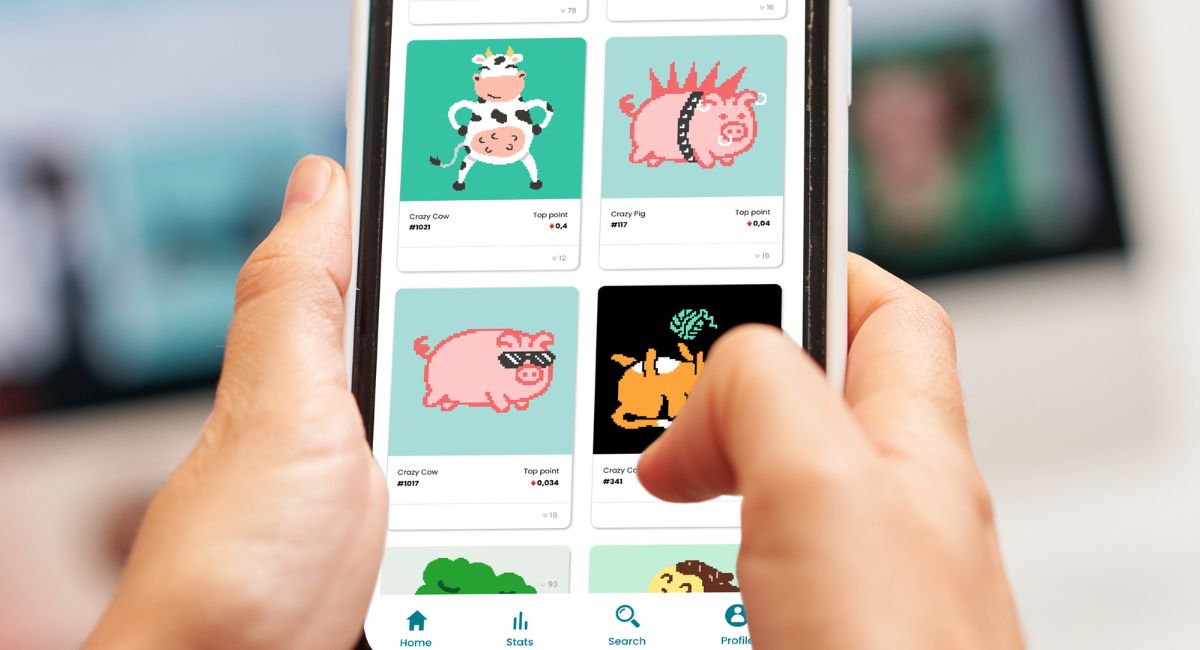

NFT trading has emerged as a prominent aspect of the digital economy, enabling the buying, selling, and exchanging of unique digital assets on blockchain platforms. Unlike cryptocurrencies like Bitcoin or Ethereum, which are fungible and interchangeable, NFTs are indivisible and represent ownership or proof of authenticity of specific digital content, ranging from artwork and music to virtual real estate and collectibles.

The process of NFT trading begins with the creation of digital assets by artists, creators, or developers, who tokenize their work by minting NFTs on blockchain networks such as Ethereum. These NFTs are then listed for sale on online marketplaces or specialized platforms, where buyers can discover and purchase them using cryptocurrency, typically Ether (ETH).

One of the key features of NFT trading is its ability to provide immutable proof of ownership and provenance through blockchain technology. Each NFT is associated with a unique identifier recorded on the blockchain, ensuring its scarcity, authenticity, and ownership history. This transparency and traceability are fundamental to the value proposition of NFTs, providing confidence to buyers and collectors in the digital assets they acquire.

NFT trading has gained widespread popularity, attracting attention from artists, celebrities, investors, and collectors seeking new ways to monetize digital content and engage with audiences. The market for NFTs has witnessed significant growth, with high-profile sales fetching millions of dollars for digital artworks, music albums, virtual real estate, and other unique creations.

However, NFT trading also faces challenges and criticism, including concerns about market speculation, copyright infringement, and environmental impact due to the energy-intensive nature of blockchain networks. Additionally, questions about the long-term value and sustainability of the NFT market remain unanswered, prompting regulators, platforms, and participants to navigate regulatory uncertainties and address emerging risks.

Despite these challenges, NFT trading represents a paradigm shift in the way digital assets are bought, sold, and valued, unlocking new opportunities for creators to monetize their work and for buyers to own unique and scarce digital collectibles. As the NFT market continues to evolve, stakeholders will need to collaborate and innovate to ensure its responsible growth and long-term viability in the digital age.

Also, read- What Is NFT Insider Trading And Top 6 Intriguing Reasons That It Matters

Machine learning

Machine learning is a subset of artificial intelligence (AI) that focuses on developing algorithms and statistical models that enable computers to learn from and make predictions or decisions based on data, without being explicitly programmed to do so. The goal of machine learning is to enable computers to learn patterns and relationships from data, allowing them to generalize and make predictions or decisions in new situations.

Machine learning algorithms are trained on large datasets, where they analyze and identify patterns, trends, and correlations. There are several types of machine learning approaches, including supervised learning, unsupervised learning, semi-supervised learning, and reinforcement learning, each suited to different types of tasks and data.

In supervised learning, algorithms are trained on labeled datasets, where each data point is associated with a target output or label. The algorithm learns to map input features to the correct output by minimizing the error between predicted and actual values.

Unsupervised learning, on the other hand, involves training algorithms on unlabeled datasets, where the goal is to discover hidden patterns or structures within the data. Clustering and dimensionality reduction are common tasks in unsupervised learning.

Semi-supervised learning combines elements of both supervised and unsupervised learning, leveraging a small amount of labeled data along with a larger amount of unlabeled data to improve model performance.

Reinforcement learning involves training algorithms to interact with an environment and learn optimal decision-making strategies through trial and error, with feedback in the form of rewards or penalties.

Machine learning has applications across various domains, including image and speech recognition, natural language processing, recommendation systems, predictive analytics, and autonomous vehicles. As the volume and complexity of data continue to grow, machine learning plays an increasingly important role in extracting insights and making data-driven decisions in both business and research settings.

💪 Have you heard about MFM? It’s an innovative crypto project “MemeMillionaires” that will take you to the Moon.

— NFT Holders™ 💎 (@NFTHolders_org) March 11, 2024

➡️ With fully locked liquidity for 88 years, it has the largest number of locked tokens on #DaVinciGraph by its investors.https://t.co/d33Fvjqq1q

📈 With a market…

Machine Learning in NFT Trading

Machine learning is increasingly being applied to NFT (Non-Fungible Token) trading to analyze market trends, predict asset valuations, and optimize trading strategies. In the context of NFT trading, machine learning algorithms can leverage historical transaction data, market sentiment analysis, and other relevant features to identify patterns and make informed predictions about the future behavior of digital assets.

One application of machine learning in NFT trading is in price-prediction models. These models analyze factors such as past sales data, asset attributes, creator reputation, and market demand to forecast the potential value of NFTs. By training on historical price movements and relevant features, machine learning algorithms can identify patterns and trends that may influence future asset valuations, helping traders make more informed decisions about buying, selling, or holding NFTs.

Another area where machine learning can be beneficial is in market sentiment analysis. By analyzing social media discussions, news articles, and other sources of information, machine learning algorithms can gauge the overall sentiment surrounding specific NFT projects or the broader market. This sentiment analysis can provide valuable insights into investor sentiment, potential market trends, and emerging opportunities or risks.

Furthermore, machine learning algorithms can be used to develop automated trading bots or algorithms that execute trades based on predefined criteria or strategies. These algorithms can continuously monitor market conditions, analyze data in real-time, and execute trades at optimal times to maximize returns or minimize risks.

Overall, machine learning holds great potential for enhancing NFT trading by providing traders with valuable insights, predictive analytics, and automated trading capabilities. As the NFT market continues to evolve and grow, machine learning algorithms are expected to play an increasingly important role in helping traders navigate the complexities of this emerging asset class.

Importance of machine learning in NFT trading

- Price Prediction: Machine learning algorithms can analyze historical sales data, asset attributes, market trends, and other factors to predict the future value of NFTs, assisting traders in making informed investment decisions.

- Market Sentiment Analysis: By analyzing social media discussions, news articles, and other sources of information, machine learning can gauge the market sentiment surrounding specific NFT projects or the broader market, providing insights into investor sentiment and potential market trends.

- Risk Management: Machine learning algorithms can assess the risk associated with NFT investments by analyzing factors such as volatility, liquidity, and correlation with other assets, helping traders manage their risk exposure more effectively.

- Automated Trading: Machine learning algorithms can be used to develop automated trading bots or algorithms that execute trades based on predefined criteria or strategies, enabling traders to capitalize on market opportunities and optimize their trading performance.

- Portfolio Optimization: Machine learning algorithms can assist traders in optimizing their NFT portfolios by identifying assets with high potential returns and low correlation, diversifying risk, and maximizing overall portfolio performance.

- Fraud Detection: Machine learning algorithms can detect fraudulent activities such as fake NFT listings, pump and dump schemes, and wash trading, helping to protect traders from scams and market manipulation.

- Market Analysis: Machine learning algorithms can analyze vast amounts of NFT market data, uncovering patterns, trends, and correlations that may not be apparent to human traders, providing valuable insights for decision-making.

- Price Arbitrage: Machine learning algorithms can identify arbitrage opportunities between different NFT marketplaces or assets, exploiting price discrepancies to generate profits for traders.

- Dynamic Pricing: Machine learning algorithms can dynamically adjust pricing strategies based on real-time market data, demand fluctuations, and competitor actions, maximizing revenue for NFT sellers.

- Market Making: Machine learning algorithms can act as market makers by providing liquidity and facilitating trades in NFT markets, helping to stabilize prices and improve market efficiency.

Conclusion

In conclusion, machine learning plays a crucial role in the rapidly evolving landscape of NFT (Non-Fungible Token) trading, offering traders a multitude of benefits ranging from price prediction and risk management to automated trading and fraud detection. By leveraging advanced algorithms to analyze vast amounts of market data, machine learning enables traders to make informed investment decisions, optimize portfolio performance, and capitalize on market opportunities more effectively.

Moreover, machine learning algorithms can provide valuable insights into market sentiment, identify arbitrage opportunities, and enhance pricing strategies, empowering traders to navigate the complexities of the NFT market with greater confidence and precision. Additionally, machine learning contributes to the overall efficiency and integrity of NFT trading by detecting fraudulent activities, providing liquidity, and improving market liquidity.

As the NFT market continues to mature and expand, the importance of machine learning in trading is expected to grow further, driving innovation, improving trading strategies, and enabling new opportunities for investors, collectors, and creators alike. However, it’s essential to recognize that machine learning is not without its challenges, including model biases, data quality issues, and regulatory considerations, which must be carefully addressed to ensure the responsible and ethical use of machine learning in NFT trading.

Overall, machine learning represents a powerful tool for unlocking insights, enhancing decision-making, and driving value creation in the dynamic and rapidly evolving world of NFT trading. By embracing machine learning technologies and harnessing their potential, traders can stay ahead of the curve, adapt to changing market conditions, and thrive in the digital economy of tomorrow.