OTC-compare.com Presents Latest Research Findings on Average Global Transaction Fees for OTC Desks (0.92%)

OTC-compare.com, a new OTC crypto desk comparison site, has unveiled the results of its recent trading desk cost analysis. After surveying over 60 OTC desks the research team have found that the average transaction cost is 0.92%.

The study aims to help consumers choose the best over-the-counter (OTC) sites for their specific requirements by summarizing transaction costs across various OTC platforms.

OTC Compare’s research explores the complex world of over-the-counter trading, going beyond just the statistics. Other factors include the platforms’ support for different currencies, the simplicity of use, and the users’ geographic location.

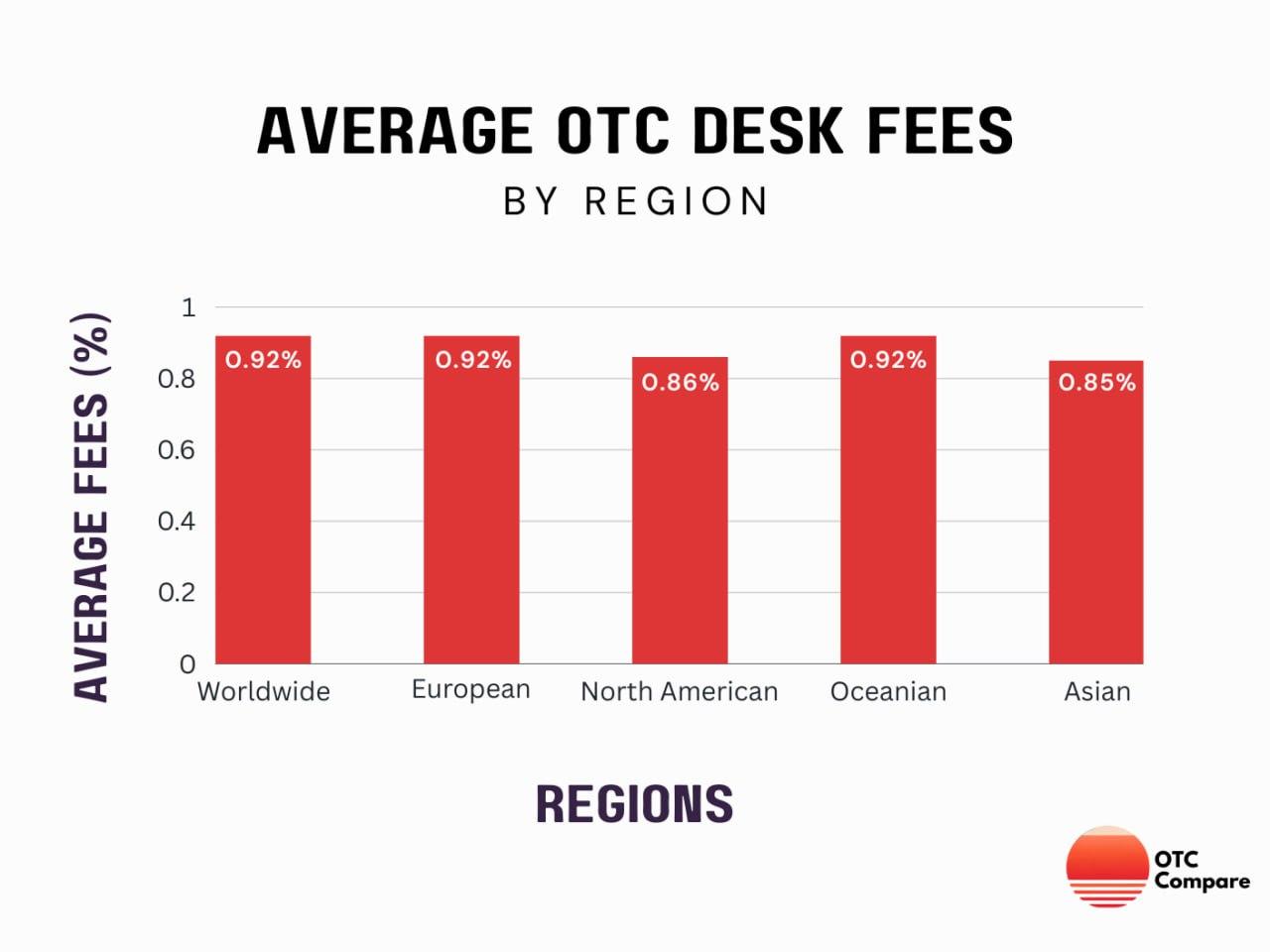

Fg.1 Asia offered the cheapest rates for trades coming in under the global average whilst the Oceanic region charged the most. Surprisingly, North America also came in under the global mean despite the generally higher costs associated.

Global Perspectives

In the study, various elements that makeup OTC trading were considered. The study explored factors such as supported fiat currencies, cryptocurrencies, and fee structures by contacting over 60 different OTC desks.

The team found that OTC desks around the globe charge an average of 0.92% for each transaction. With an average cost of 0.92%, Europe stood firm in over-the-counter transactions. North America’s average, however, was 0.86%. The Oceanian region mirrored the world average – 0.92% while the transaction costs in Asia settled at an average of 0.85%.

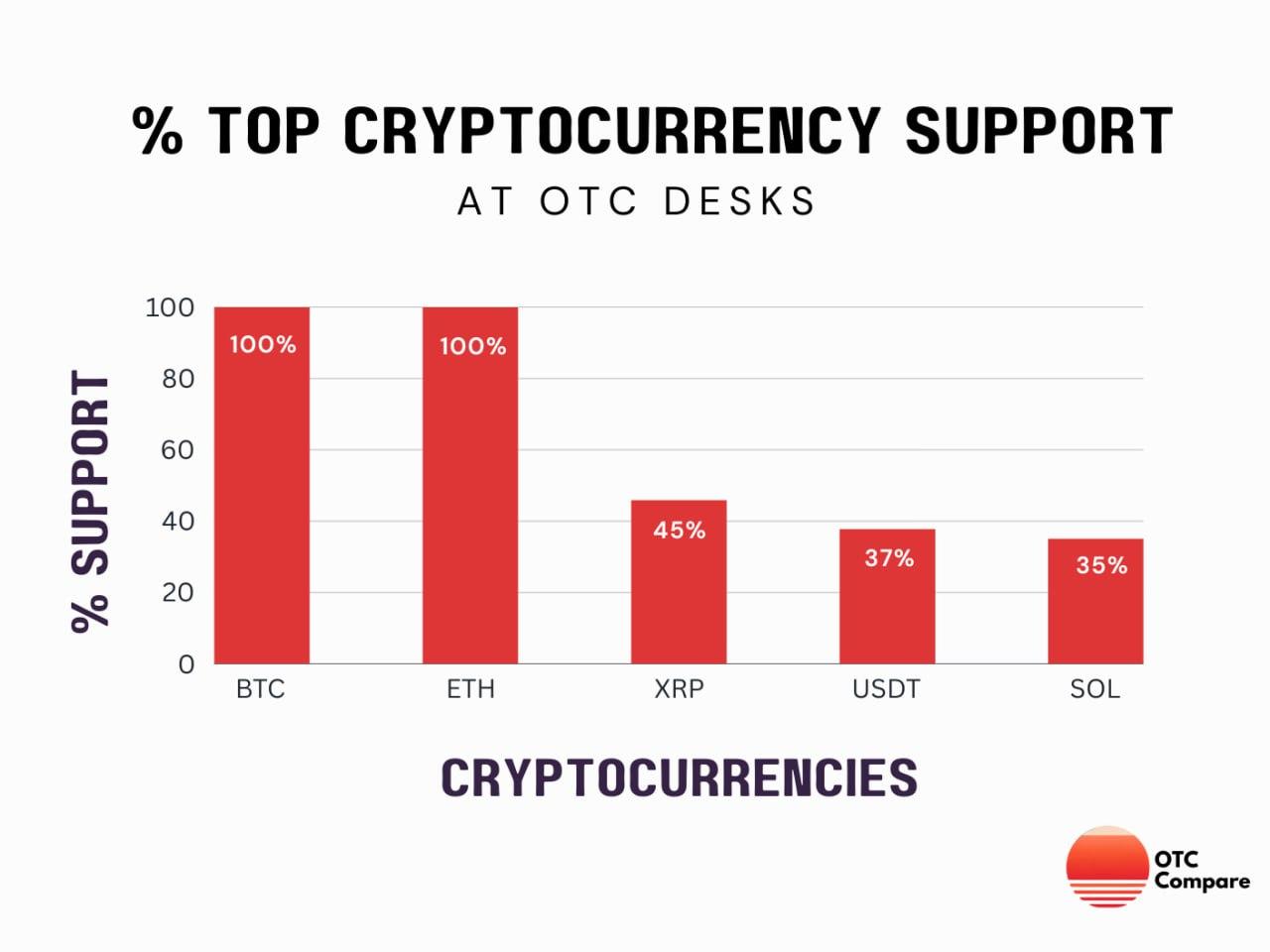

The study also looked into % support for cryptocurrencies at OTC desk. Bitcoin and Ether took 1st and 2nd place in offerings at desks with XRP and USDT in third and fourth respectively.

Decoding OTC Dynamics

According to the study, a complex connection arises for OTC fees depending on the size of the transactions. Lower fee values may be associated with greater transaction amounts, while higher fees may be associated with smaller transaction quantities. This shows the relationship between the magnitude of a transaction and the charges involved in over-the-counter trading.

The effect of traded asset liquidity on transaction costs was also explored in the study. It concludes that transactions involving more liquid assets may incur reduced fees and vice versa for more illiquid deals. This finding highlights the importance of asset liquidity in determining cost and further complicates the charge structures within OTC trading.

The research highlighted the usual divide between the “makers” and the “takers” in financial transactions. One key difference is that ‘makers,’ or players who place limit orders, usually pay less. However, ‘takers,’ responsible for carrying out market orders, often see increased costs. The significance of trading tactics and order kinds in shaping the monetary dynamics of over-the-counter transactions is highlighted by this discovery.

Why use an OTC desk?

The report considered the reasons why people use OTC exchange desks. The specialized demands of players engaged in big trades are catered to by these platforms, which operate outside typical cryptocurrency exchanges and specialize in enabling higher-value transactions. Additionally, trading on OTC desks is more discreet and individualized than with traditional order books.

Unlike traditional exchanges, where all participants may see the order books, over-the-counter desks emphasize privacy and customization. A more personal trading experience is provided, allowing players to deal secretly away from prying eyes. People looking for a more discreet and individual way to trade cryptocurrencies may find OTC desks appealing because of this feature.

Investors and traders alike will feel safer in this more closely monitored market. Notably, players looking to conform to regulatory norms may be more attracted to OTC desks. For individuals trying to make sense of the maze of cryptocurrency legislation, this dedication to compliance bolsters the legitimacy of over-the-counter trading.