Top 10 Biggest Ethereum ICOs Of All Times

Ethereum ICOs, or Initial Coin Offerings, were a popular method used by blockchain projects to raise funds and distribute tokens on the Ethereum platform. ICOs emerged as a way for startups to secure capital for their projects by selling tokens to investors in exchange for cryptocurrencies, typically Ethereum (ETH), which served as the primary currency for ICO investments.

During an ICO, the project team would create a smart contract on the Ethereum blockchain, which defined the rules and conditions of the token sale. The smart contract would specify details such as the total supply of tokens, the price per token, the duration of the ICO, and any additional features or benefits associated with the tokens.

Investors interested in participating in the ICO would send their Ethereum to the designated address provided by the project team. In return, they would receive the project’s tokens based on the predetermined exchange rate. These tokens were often built on the ERC-20 standard, a technical standard on the Ethereum blockchain that facilitated the creation and management of tokens.

ICOs gained significant popularity during the cryptocurrency boom of 2017 and early 2018. Many projects used ICOs as a way to raise capital quickly and efficiently, often bypassing traditional funding methods like venture capital or initial public offerings (IPOs). The allure of ICOs was that anyone with access to cryptocurrencies could invest, democratizing access to early-stage investment opportunities.

Investors were drawn to ICOs due to the potential for high returns on their investments if the projects were successful. If a project gained traction and the value of its tokens increased, early investors could potentially sell their tokens on cryptocurrency exchanges at a profit.

However, ICOs also faced several challenges and risks. The lack of regulatory oversight and the absence of standardized frameworks for evaluating projects made it difficult for investors to assess the credibility and viability of ICOs. Many projects turned out to be scams or failed to deliver on their promises, leading to financial losses for investors.

Furthermore, the unregulated nature of ICOs raised concerns about investor protection, money laundering, and fraudulent activities. In response, regulatory bodies around the world started to scrutinize ICOs and impose stricter regulations to protect investors and maintain market integrity.

As a result of these challenges and regulatory changes, the popularity of ICOs has waned in recent years. Many projects have shifted towards alternative fundraising methods, such as security token offerings (STOs) that comply with securities regulations, or initial exchange offerings (IEOs) conducted on cryptocurrency exchanges.

It’s important to note that this information is based on the state of knowledge up until September 2021, and the landscape of ICOs may have evolved since then due to changing regulations and market dynamics.

Also read: The Impact Of Ethereum On The Blockchain Industry: A Look At The Platform’s History And Future

Use Cases of Ethereum ICOs

Ethereum ICOs, or Initial Coin Offerings, were utilized by various projects to fundraise and leverage the capabilities of the Ethereum blockchain. These ICOs offered a wide range of use cases and potential applications. Here are some of the common use cases of Ethereum ICOs:

1. Decentralized Applications (DApps): ICOs enabled the funding of decentralized applications built on the Ethereum blockchain. DApps aim to eliminate intermediaries and create trustless systems by utilizing smart contracts. ICOs provided a means for DApp developers to secure the necessary capital for development, marketing, and deployment of their decentralized applications.

2. Blockchain Infrastructure: ICOs were often used to raise funds for projects focused on building and improving the underlying infrastructure of the Ethereum network. These projects aimed to enhance scalability, security, and interoperability. Examples include projects developing layer-2 scaling solutions, consensus mechanisms, cross-chain bridges, and decentralized storage solutions.

3. Tokenized Assets and Ownership: ICOs enabled the tokenization of real-world assets, such as real estate, commodities, or intellectual property rights. By issuing tokens on the Ethereum blockchain, these projects allowed investors to gain fractional ownership or access to the value of the underlying asset. This tokenization process could unlock liquidity and facilitate more efficient trading and transfer of ownership.

4. Identity and Digital Identity Management: Some ICOs focused on building decentralized identity solutions on the Ethereum blockchain. These projects aimed to provide individuals with control over their personal data and allow for secure and portable digital identity management. ICOs funded initiatives exploring self-sovereign identity, identity verification, and authentication systems.

5. Financial Services and DeFi: ICOs played a crucial role in the rise of decentralized finance (DeFi) applications. DeFi projects aimed to create financial services and instruments using smart contracts, without the need for intermediaries like banks or traditional financial institutions. ICOs facilitated the funding of projects developing decentralized lending platforms, decentralized exchanges (DEXs), stablecoins, yield farming protocols, and other financial tools.

6. Gaming and Non-Fungible Tokens (NFTs): ICOs supported the development of blockchain-based gaming platforms and NFT ecosystems. NFTs are unique digital assets that can represent ownership of in-game items, digital art, collectibles, and more. ICOs provided funding for projects exploring the integration of NFTs into gaming, virtual reality, digital art marketplaces, and other interactive experiences.

7. Social Impact and Governance: Some ICOs were launched to fund projects with a social or environmental impact. These initiatives sought to leverage blockchain technology to address global challenges such as poverty, inequality, supply chain transparency, and environmental sustainability. ICOs enabled crowdfunding for projects focused on social welfare, humanitarian efforts, and decentralized governance models.

It’s important to note that while Ethereum ICOs presented a wide array of potential use cases, not all ICOs succeeded or delivered on their promises. The inherent risks associated with investing in ICOs, including scams, regulatory challenges, and project failures, necessitate thorough research and due diligence before participating in any ICO.

NFTs were a killer app built on Ethereum. So were ICOs. Next killer apps will be built on Polygon and Solana, Cosmos, Aptos, etc. Major infrastructure is going to transition to web3 under our feet. Bitcoin will not be a part of that. https://t.co/c79rtoMYXe

— Dick Masterson (@dickmasterson) February 17, 2023

Also read: 7 Notable Ethereum Investors You Should Be Aware Of

Top 10 Biggest Ethereum ICOs of All Time

Initial coin offerings (ICOs) are a way for blockchain projects to raise funds by selling their own tokens to investors. Ethereum is the most popular blockchain platform for ICOs, and some of the biggest ICOs in history have been conducted on the Ethereum network.

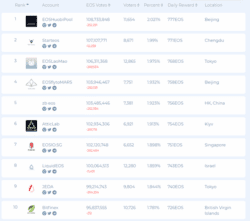

Here is a list of the top 10 biggest Ethereum ICOs of all time, ranked by the amount of funds raised:

- EOS (4.2 billion USD)

- NEO (31.5 million USD)

- Ethereum (18.4 million USD)

- Ark (16.6 million USD)

- NXT (14.2 million USD)

- IOTA (13.3 million USD)

- Alias (6.7 million USD)

- Stratis (3.2 million USD)

- Cardano (2.5 million USD)

- Lisk (517,200 USD)

As you can see, the top 10 biggest Ethereum ICOs raised a total of over $100 billion USD in funds. This shows the incredible potential of Ethereum as a platform for raising capital for blockchain projects.

It is important to note that the success of an ICO is not guaranteed. Some ICOs have been very successful, while others have failed to deliver on their promises. Investors should always do their own research before investing in any ICO.

However, the top 10 Ethereum ICOs listed above have all been relatively successful. They have all raised significant amounts of funds and have developed active communities of users. As a result, they are considered to be some of the most promising blockchain projects in the world.

If you are interested in investing in an Ethereum ICO, it is important to do your research and choose a project that you believe in. You should also be prepared to invest for the long term, as the success of any blockchain project will take time to materialize.

Benefits of using Ethereum ICOs

Ethereum ICOs, or Initial Coin Offerings, offered several benefits to both project teams and investors, which contributed to their popularity during the cryptocurrency boom. Here are some of the key benefits of using Ethereum ICOs:

1. Access to Capital: ICOs provided a means for blockchain projects to raise funds from a global pool of investors. Unlike traditional funding methods like venture capital, ICOs democratized access to capital, allowing startups and entrepreneurs to secure funding without going through traditional intermediaries. This open and inclusive nature of ICOs enabled projects from around the world to receive support and funding for their ideas.

2. Tokenization and Liquidity: Through ICOs, projects could create and distribute tokens that represented ownership or access rights within their ecosystems. Tokenization allowed for fractional ownership of assets, such as real estate or intellectual property, making them more liquid and tradable. ICO participants could potentially benefit from the liquidity and value appreciation of these tokens if the project succeeded and gained wider adoption.

3. Global Investor Base: ICOs attracted investors from different geographical locations, providing projects with a broader and more diverse investor base. This global reach allowed projects to tap into a wide range of perspectives, expertise, and resources. It also facilitated the building of communities and networks of supporters who could contribute to the project’s success through participation, feedback, and advocacy.

4. Early Adopter Incentives: ICOs often provided incentives for early adopters and investors. Projects would typically offer discounted token prices or additional benefits to those who participated in the early stages of the ICO. This incentivized early investment and helped bootstrap the project’s ecosystem by attracting initial users, developers, and partners.

5. Blockchain Integration: Ethereum ICOs leveraged the capabilities of the Ethereum blockchain and smart contracts. The Ethereum platform provided a secure and transparent infrastructure for conducting ICOs, ensuring the integrity of transactions and the issuance of tokens. Smart contracts enabled automated execution of ICO rules, such as token distribution, vesting schedules, and lock-up periods, reducing the need for manual intervention and enhancing trust in the process.

6. Community Building: ICOs enabled projects to build communities around their ideas and initiatives. Investors who participated in ICOs became early supporters and advocates for the project. They formed communities through social media channels, forums, and events, creating a network effect and fostering collaboration. These communities often provided valuable feedback, ideas, and contributed to the project’s growth and development.

7. Innovation and Disruption: ICOs fueled innovation by supporting projects exploring novel use cases and disruptive technologies. The ICO model allowed unconventional ideas to receive funding and gain traction, challenging traditional industries and business models. This environment of experimentation and exploration contributed to the rapid evolution of the blockchain and cryptocurrency ecosystem.

It’s worth noting that while Ethereum ICOs offered these benefits, they also presented risks and challenges, such as regulatory uncertainty, scams, and project failures. The lack of regulations and standardization in the ICO space heightened the importance of conducting thorough due diligence and risk assessment before participating in any ICO.

Also read: Top 5 Use Cases Of Ethereum Smart Contracts

Future of Ethereum ICOs

As of my knowledge cutoff in September 2021, the future of Ethereum ICOs, or Initial Coin Offerings, is subject to various factors and uncertainties. However, I can provide some insights into potential directions and developments that may shape the future of ICOs on the Ethereum platform. It’s important to note that the cryptocurrency and blockchain landscape is dynamic, and these projections may not fully capture the current state of affairs. Here are some key points to consider:

1. Evolving Regulatory Landscape: Regulatory bodies worldwide have been closely scrutinizing ICOs due to concerns around investor protection, fraud, and money laundering. Many countries have introduced or are considering regulations to bring ICOs under their legal frameworks. The future of Ethereum ICOs will likely be influenced by these regulatory developments. Compliance requirements, such as know-your-customer (KYC) and anti-money laundering (AML) procedures, may become more stringent, imposing greater accountability and transparency on projects.

2. Shift Towards Security Token Offerings (STOs): Security Token Offerings have emerged as a regulated alternative to ICOs. STOs are token sales that comply with securities regulations, providing investors with legal protections and rights. STOs may gain traction in the future as a more compliant and regulated fundraising method. These offerings could attract institutional investors and provide greater legitimacy to the blockchain industry, potentially leading to a decline in the popularity of traditional ICOs.

3. Increased Investor Scrutiny and Due Diligence: The experiences of scams, fraudulent projects, and unsuccessful ICOs have made investors more cautious and discerning. Going forward, investors are likely to conduct more thorough due diligence before participating in ICOs, including evaluating project teams, reviewing whitepapers, and analyzing the feasibility and viability of the proposed projects. This increased scrutiny may lead to a higher quality standard for projects seeking to conduct ICOs, with a focus on delivering tangible value and solving real-world problems.

4. Emergence of Alternative Fundraising Methods: ICOs have faced criticisms and challenges, such as a lack of investor protection and regulatory oversight. As a result, alternative fundraising methods have gained popularity. Initial Exchange Offerings (IEOs) conducted on cryptocurrency exchanges and Initial DEX Offerings (IDOs) hosted on decentralized exchanges (DEXs) have become prevalent. These methods offer a more curated and controlled environment for token sales, potentially displacing traditional ICOs.

5. Integration with Decentralized Finance (DeFi): DeFi has experienced significant growth, providing decentralized financial services and applications on the Ethereum blockchain. The integration of ICOs with DeFi platforms could offer new avenues for fundraising and liquidity provision. Projects may explore innovative token sale models, such as token auctions, liquidity bootstrapping pools, or token distribution through decentralized lending protocols.

6. Focus on User Adoption and Utility: In the past, ICOs primarily focused on fundraising, often leaving the question of real-world utility and adoption unanswered. Future Ethereum ICOs may place greater emphasis on the practical application and adoption of tokens within the project’s ecosystem. Projects will need to demonstrate clear use cases, value propositions, and strategies for achieving widespread adoption to attract investors and build sustainable communities.

7. Continued Innovation and Iteration: The Ethereum ecosystem is dynamic, and advancements such as Ethereum 2.0, layer-2 scaling solutions, and improved smart contract functionality may shape the future of ICOs. These technological developments could address scalability, security, and cost issues associated with ICOs, making them more efficient and accessible.

It’s important to acknowledge that these projections are speculative and the future of Ethereum ICOs will be influenced by a wide range of factors, including market dynamics, regulatory frameworks, technological advancements, and investor sentiment.