Top 10 Least Favourite Aspects of Crypto by GenZ

Crypto, short for cryptocurrency, refers to digital or virtual currencies that utilize cryptographic technology to secure and verify transactions. Unlike traditional fiat currencies issued by central banks, cryptocurrencies are decentralized and operate on a peer-to-peer network called blockchain.

The concept of cryptocurrencies originated with the release of Bitcoin in 2009 by an anonymous person or group of individuals using the pseudonym Satoshi Nakamoto. Bitcoin introduced the revolutionary idea of a decentralized digital currency that could be exchanged without the need for intermediaries like banks.

Cryptocurrencies rely on cryptographic algorithms to secure transactions, control the creation of new units, and verify the transfer of assets. These algorithms ensure the integrity and authenticity of transactions, making it extremely difficult for malicious actors to manipulate or counterfeit the currency.

One of the key features of cryptocurrencies is the use of a decentralized ledger called a blockchain. A blockchain is a distributed and immutable ledger that records all transactions across a network of computers, known as nodes. Each transaction is grouped into a block, which is then added to the chain in a chronological order. This creates a transparent and tamper-resistant record of all transactions, accessible to anyone on the network.

Cryptocurrencies have gained popularity due to several factors. Firstly, they offer potential advantages over traditional banking systems, such as faster and cheaper cross-border transactions. Traditional methods of transferring money internationally can be costly and time-consuming, involving intermediaries, fees, and delays. Cryptocurrencies can facilitate near-instantaneous transfers with lower fees, eliminating the need for intermediaries.

Secondly, cryptocurrencies provide financial inclusivity to individuals who lack access to traditional banking services. All that is required to participate in the cryptocurrency ecosystem is an internet connection and a digital wallet. This accessibility has the potential to empower individuals in underbanked regions, enabling them to participate in the global economy.

Furthermore, cryptocurrencies offer the potential for increased privacy and security. While transactions conducted with cryptocurrencies are recorded on the blockchain, users are generally identified by their cryptographic addresses rather than personal information. This pseudonymous nature of transactions provides a certain level of privacy, although it is worth noting that the transparency of the blockchain can still allow for analysis and identification in some cases.

In addition to Bitcoin, thousands of alternative cryptocurrencies, collectively known as altcoins, have been created over the years. These include Ethereum, Ripple, Litecoin, and many others, each with its unique features and use cases. Some cryptocurrencies serve as a means of exchange, while others aim to provide platforms for decentralized applications or facilitate specific industry use cases such as supply chain management or identity verification.

However, it is important to note that the cryptocurrency market is highly volatile and speculative. Prices can experience significant fluctuations within short periods, and there is a degree of uncertainty and risk associated with investing in cryptocurrencies. Regulatory frameworks and government attitudes towards cryptocurrencies vary across different jurisdictions, leading to further uncertainty and potential challenges.

Overall, cryptocurrencies represent a groundbreaking technological innovation with the potential to reshape the financial landscape. They offer alternative means of exchange, increased financial inclusivity, and the possibility of disrupting traditional financial systems. However, the adoption and acceptance of cryptocurrencies are still evolving, and their long-term impact remains to be seen.

Also read: The Birth Of Crypto: How Bitcoin Signalled The Start Of An All New FinTech World

Relationship between Crypto and GenZ

Crypto and Generation Z (Gen Z) have a unique and evolving relationship that is shaped by a combination of factors, including technological proficiency, financial aspirations, and a desire for independence. Here are some key points that highlight the relationship between crypto and Gen Z:

1. Technological Natives: Gen Z is often referred to as “digital natives” as they have grown up in an era where technology, including the internet and smartphones, has always been a part of their lives. This generation is typically more tech-savvy and comfortable with digital platforms and innovations, making them more open to embracing cryptocurrencies.

2. Financial Awareness and Independence: Gen Z has witnessed significant financial events like the 2008 global financial crisis, which has shaped their attitudes towards traditional financial systems. Many Gen Z individuals are wary of traditional banks and financial institutions and seek alternative means of managing their money. Cryptocurrencies, with their decentralized and peer-to-peer nature, align with the desire for financial independence and control.

3. Economic Opportunities: Gen Z is known for its entrepreneurial spirit and a desire to explore alternative income streams. Cryptocurrencies provide a unique avenue for Gen Z individuals to participate in the digital economy. They can engage in activities such as cryptocurrency mining, trading, investing, or even launching their own blockchain-based projects or startups.

4. Access to Global Markets: Cryptocurrencies offer Gen Z the opportunity to engage in global markets without the traditional barriers that exist in the financial industry. Cryptocurrency exchanges and platforms provide easy access to a range of digital assets, allowing Gen Z to invest, trade, and transact with people from different parts of the world, 24/7.

5. Social and Activist Movements: Gen Z is often characterized as socially conscious and concerned about global issues. Cryptocurrencies, particularly those built on decentralized blockchain platforms, align with their values of transparency, fairness, and democratization. They see the potential for cryptocurrencies to disrupt traditional power structures, promote financial inclusion, and facilitate peer-to-peer transactions without intermediaries.

6. Education and Awareness: Gen Z has grown up in an era of abundant information and connectivity. They have access to various online resources, tutorials, and communities that help them understand and navigate the world of cryptocurrencies. Gen Z individuals are more likely to actively seek information, learn about blockchain technology, and engage in discussions on social media platforms or specialized cryptocurrency forums.

7. Potential Risks and Challenges: While Gen Z is generally receptive to cryptocurrencies, it’s crucial to acknowledge that they may lack experience and be more susceptible to scams or fraudulent activities in the crypto space. Educating Gen Z about responsible investing, security measures, and the risks associated with cryptocurrencies is essential to protect them from potential pitfalls.

Overall, the relationship between Gen Z and cryptocurrencies is characterized by a combination of technological familiarity, financial aspirations, and a desire for independence. As this generation matures and gains more financial and investment experience, their impact on the cryptocurrency space is expected to grow, shaping the future of digital finance.

Top 10 Least Favourite aspects of Crypto by GenZ

Sure, here is an article about the top 10 least favorite aspects of crypto by Gen Z:

Top 10 Least Favorite Aspects of Crypto by Gen Z

Gen Z is one of the most crypto-savvy generations, with many young people investing in cryptocurrencies and other digital assets. However, even Gen Z is not immune to the risks and challenges of crypto. Here are some of the top 10 least favorite aspects of crypto by Gen Z:

- Volatility: The price of cryptocurrencies is notoriously volatile, meaning that it can fluctuate wildly in a short period of time. This can make it difficult to predict how much an investment will be worth in the future, and it can also lead to significant losses if the price of a coin plummets.

- Energy consumption: The mining process for some cryptocurrencies, such as Bitcoin, requires a significant amount of energy. This has led to concerns about the environmental impact of crypto, and it has also made some Gen Zers wary of investing in these coins.

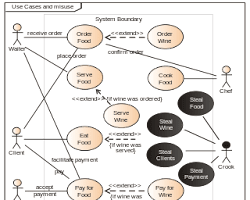

- Fraud and scams: There have been a number of high-profile crypto scams in recent years, which has led some Gen Zers to be wary of investing in crypto. These scams can take many forms, such as fake investment opportunities or phishing attacks.

- Lack of regulation: Cryptocurrencies are not currently regulated by any major government or financial institution. This can make it difficult for investors to protect their money, and it can also make it more difficult to hold crypto exchanges and other companies accountable for their actions.

- High entry barrier: The cost of buying and storing cryptocurrencies can be a barrier for some Gen Zers, who may not have a lot of disposable income. Additionally, the technical knowledge required to buy and sell crypto can be daunting for some young people.

- Environmental impact: As mentioned above, the mining process for some cryptocurrencies can have a significant environmental impact. This is a concern for many Gen Zers, who are more environmentally conscious than previous generations.

- Illiquidity: Cryptocurrencies are not as liquid as traditional assets, such as stocks or bonds. This means that it can be difficult to sell crypto quickly if you need to access your money.

- Complexity: Cryptocurrencies can be complex and difficult to understand, even for experienced investors. This can make it difficult for Gen Zers to make informed investment decisions.

- Lack of use cases: Some Gen Zers are not convinced that cryptocurrencies have a real-world use case. They see crypto as a speculative investment, rather than a currency that can be used to buy goods and services.

- Uncertain future: The future of cryptocurrency is uncertain. It is possible that crypto will become a mainstream currency, but it is also possible that it will fade away. This uncertainty can make it difficult for Gen Zers to invest in crypto.

Despite these challenges, many Gen Zers are still optimistic about the future of crypto. They believe that crypto has the potential to revolutionize the way we think about money, and they are willing to take on the risks in order to be a part of this new financial system.

Every Chinese GenZ in crypto is talking about dropouts, and most of them don’t even understand the causal relationship between being wealthy and dropouts.

— John Doe (@0xtroll) March 24, 2022

Risks of using Crypto

While cryptocurrencies offer numerous benefits, it is essential to be aware of the risks associated with their use. Here are some key risks to consider when using cryptocurrencies:

1. Volatility: Cryptocurrencies are known for their price volatility. The value of cryptocurrencies can fluctuate significantly within short periods, leading to potential gains or losses. Rapid price movements can be influenced by various factors, including market speculation, regulatory changes, media coverage, and investor sentiment. This volatility can pose risks for investors and traders, as it can result in substantial financial losses if not managed carefully.

2. Security Threats: Cryptocurrency transactions rely on cryptographic protocols to secure and verify transactions. However, security risks still exist in the crypto space. One significant risk is the potential for hacking and theft. Cybercriminals can target cryptocurrency exchanges, wallets, or individual users to gain unauthorized access to digital assets. It is crucial to take precautions such as using strong passwords, enabling two-factor authentication, and storing cryptocurrencies in secure wallets to mitigate these risks.

3. Regulatory Uncertainty: Cryptocurrencies operate in a complex regulatory landscape that varies across jurisdictions. Governments and regulatory bodies worldwide are still formulating policies and regulations to govern the use and trading of cryptocurrencies. Regulatory changes or crackdowns on cryptocurrency activities can impact their value and usability. Additionally, uncertainties related to taxation, anti-money laundering (AML) regulations, and know-your-customer (KYC) requirements can create challenges for individuals and businesses involved in cryptocurrency transactions.

4. Lack of Consumer Protection: Unlike traditional financial systems, cryptocurrencies often lack the same level of consumer protection measures. Transactions made with cryptocurrencies are typically irreversible, and the pseudonymous nature of blockchain transactions makes it challenging to trace and recover funds in case of fraudulent activity. If a user loses access to their cryptocurrency wallet or falls victim to a scam, it can be challenging to retrieve the lost funds. It is crucial to be cautious, use reputable platforms and services, and understand the risks associated with cryptocurrency transactions.

5. Market Manipulation: Cryptocurrency markets are susceptible to market manipulation practices, including pump-and-dump schemes, where certain individuals or groups artificially inflate the price of a cryptocurrency to attract investors and then sell off their holdings, causing prices to crash. Illiquid markets and low trading volumes can make cryptocurrencies particularly vulnerable to such manipulation. Investors should exercise caution, conduct thorough research, and be aware of potential market manipulation risks.

6. Lack of Regulation and Oversight: The decentralized nature of cryptocurrencies means that they are not regulated or overseen by a central authority. While this provides benefits such as financial autonomy and privacy, it also means that the market is more susceptible to fraudulent schemes, scams, and unregulated activities. Investors and users must be diligent in their due diligence and only engage with reputable and regulated entities to mitigate these risks.

7. Technical Challenges: Cryptocurrencies rely on complex technologies such as blockchain and smart contracts. While these technologies offer numerous advantages, they are still relatively new and evolving. Issues such as software bugs, network congestion, scalability limitations, and interoperability challenges can arise. These technical challenges can impact the usability, performance, and security of cryptocurrencies.

It is important to note that the risks associated with cryptocurrencies can be mitigated through proper education, security measures, risk management strategies, and adherence to regulatory guidelines. Understanding these risks and taking appropriate precautions can help users navigate the crypto space more effectively and make informed decisions regarding the use and investment in cryptocurrencies.

Future of Crypto and GenZ

The future of cryptocurrencies and their relationship with Generation Z (Gen Z) is an intriguing and dynamic subject. Here are some key aspects to consider when discussing the future of crypto and its impact on Gen Z:

1. Adoption and Integration: Gen Z is expected to play a crucial role in the widespread adoption and integration of cryptocurrencies. As a tech-savvy generation that has grown up with digital technologies, Gen Z is more likely to embrace cryptocurrencies and blockchain-based solutions. Their familiarity with digital platforms, mobile apps, and online transactions makes them well-positioned to explore and adopt cryptocurrencies as part of their everyday lives.

2. Financial Independence: Gen Z, often characterized by its desire for financial independence, sees cryptocurrencies as a means to gain more control over their financial lives. Cryptocurrencies offer the potential for decentralized finance (DeFi), enabling individuals to access financial services such as lending, borrowing, and earning interest without relying on traditional banks. Gen Z’s affinity for alternative income streams, entrepreneurship, and financial experimentation aligns well with the possibilities offered by cryptocurrencies.

3. Entrepreneurship and Innovation: Gen Z is known for its entrepreneurial spirit and inclination toward innovation. Cryptocurrencies and blockchain technology provide a fertile ground for Gen Z entrepreneurs to create innovative solutions, launch decentralized applications (dApps), or contribute to the development of blockchain-based projects. As this generation brings fresh perspectives and ideas, we can expect to see increased entrepreneurship and disruptive innovations in the crypto space.

4. Social Impact and Activism: Gen Z is characterized by its social consciousness and passion for making a positive impact on the world. Cryptocurrencies, with their potential to promote financial inclusion, transparency, and decentralized governance, resonate with Gen Z’s values. We can anticipate Gen Z individuals leveraging cryptocurrencies to support social causes, engage in impact investing, and participate in decentralized networks that aim to address various societal challenges.

5. Education and Awareness: Gen Z has grown up in an era of abundant information, and they are proactive in seeking knowledge and staying informed. This generation is likely to continue educating themselves about cryptocurrencies, blockchain technology, and the potential applications they offer. With access to online resources, forums, social media platforms, and educational initiatives, Gen Z will play an active role in shaping the discourse surrounding cryptocurrencies and contributing to their development and adoption.

6. Regulatory Developments: As cryptocurrencies become more mainstream, governments and regulatory bodies will continue to develop frameworks and guidelines to address the evolving landscape. Gen Z individuals may engage in discussions, advocacy, and activism to shape regulatory decisions that align with their values and aspirations. Their involvement in policy-making processes can influence the direction of crypto regulations and create a more conducive environment for innovation and growth.

7. Privacy and Security Concerns: Gen Z’s heightened awareness of privacy and security issues may influence the future development of cryptocurrencies. As concerns around data breaches and surveillance grow, Gen Z individuals may seek out privacy-focused cryptocurrencies and blockchain technologies that prioritize user confidentiality. This may drive the development of solutions that enhance privacy protections while ensuring compliance with regulatory requirements.

It is important to note that the future of crypto and Gen Z is not without challenges. Volatility, regulatory uncertainties, and the risk of scams or security breaches remain relevant considerations. However, with the combination of Gen Z’s unique characteristics, technological fluency, and desire for financial autonomy, the future of crypto looks promising. Gen Z’s participation in the crypto space has the potential to drive innovation, disrupt traditional financial systems, and shape the future of digital finance.

Also read: Millennials Vs Gen Z: Top 10 Reasons Gen Z Crypto Adoption Is Faster Than Millennials