Top 10 NFT Liquidity Protocols Of 2023

NFTs are unique digital assets that can represent ownership or proof of authenticity for various types of digital or physical items, such as artwork, collectibles, virtual real estate, domain names, and more. Unlike cryptocurrencies like Bitcoin or Ethereum, which are fungible and can be exchanged on a one-to-one basis, NFTs have distinct properties and cannot be directly exchanged with one another. Several NFT liquidity protocols have emerged to address the specific requirements and functionalities of the NFT ecosystem. Here are some of the most notable protocols:

1. ERC-721: ERC-721 is the first widely adopted NFT standard on the Ethereum blockchain. It defines a set of rules for creating and managing non-fungible tokens. Each ERC-721 token has a unique identifier (token ID), and the standard includes functions for transferring ownership, querying token metadata, and implementing additional features like royalties and marketplace integrations.

2. ERC-1155: ERC-1155 is an extension of the ERC-721 standard that supports the creation of both fungible and non-fungible tokens within a single smart contract. This standard provides greater flexibility for developers and reduces the gas costs associated with deploying multiple contracts for different token types. ERC-1155 allows for batch transfers and is often used in gaming applications where both unique items and in-game currencies are required.

3. Binance Smart Chain: Binance Smart Chain (BSC) is a blockchain platform developed by Binance, which has gained popularity due to its low transaction fees and fast block confirmations. BSC has its own set of NFT standards, including BEP-721 (similar to ERC-721) and BEP-1155 (similar to ERC-1155), allowing developers to create and interact with NFTs on the Binance Smart Chain ecosystem.

4. Flow: Flow is a blockchain platform specifically designed for the development of decentralized applications (DApps) and NFTs. Flow has its native programming language, Cadence, and its own set of NFT standards. The primary standard is called Fungible Token Standard (FT) and is used for creating fungible tokens. For NFTs, Flow has its own standard called Non-Fungible Token Standard (NFT), which provides the necessary functionality for creating, owning, and transferring unique tokens.

5. Polygon: Polygon (previously known as Matic Network) is a layer 2 scaling solution for Ethereum, aimed at improving scalability and reducing transaction costs. It offers support for NFTs and has its own set of NFT standards, including MATIC-721 (similar to ERC-721) and MATIC-1155 (similar to ERC-1155). Polygon provides developers with a faster and more cost-effective environment for building NFT applications on top of Ethereum.

These are just a few examples of NFT protocols that exist within the blockchain ecosystem. Each protocol has its own set of features, advantages, and communities. Developers and users choose the protocol that best aligns with their needs, whether it be based on the Ethereum blockchain or other emerging blockchain platforms.

Importance of NFT liquidity protocols for the economy

NFT protocols play a crucial role in shaping and facilitating the economy of non-fungible tokens. Here are several reasons why NFT protocols are important for the economy:

1. Authenticity and Provenance: NFT protocols provide a mechanism for verifying the authenticity and provenance of digital assets. By utilizing blockchain technology, NFTs can be uniquely identified, timestamped, and traced back to their original creators or owners. This ensures that digital assets, such as artwork or collectibles, can be verified as genuine and have a documented history, which enhances their value in the marketplace.

2. Ownership and Property Rights: NFT protocols establish a framework for defining and transferring ownership of digital assets. Through smart contracts, these protocols enable secure and transparent ownership transfers, ensuring that the rightful owners of NFTs are recognized and that transactions can be conducted with confidence. This aspect is particularly important for creators and artists who can protect their intellectual property and monetize their work more effectively.

3. Fractional Ownership and Investment: NFT protocols allow for the fractional ownership of assets, meaning that multiple individuals can own a portion of an NFT. This fractional ownership model opens up new opportunities for investment, as individuals can collectively invest in high-value assets that may have been unattainable for an individual buyer. Fractional ownership also enables more liquidity in the market, as individuals can buy and sell fractional shares of NFTs.

4. Secondary Market Trading and Royalties: NFT protocols facilitate the trading of digital assets on secondary markets. Once an NFT is initially purchased from the creator, subsequent sales can be made on platforms that support NFT trading. NFT protocols can include mechanisms for royalty payments, enabling creators to earn a percentage of the sale price each time their NFT is resold. This provides ongoing revenue streams for creators and incentivizes them to continue producing valuable digital assets.

5. Interoperability and Cross-Platform Integration: NFT protocols promote interoperability and cross-platform integration, allowing NFTs to be utilized in a variety of applications and environments. These protocols define standards that enable NFTs to be seamlessly transferred and utilized across different blockchain networks, marketplaces, and applications. This interoperability expands the reach and utility of NFTs, making them more accessible and valuable to a broader range of users and industries.

6. Economic Opportunities and Job Creation: The emergence of NFTs and the associated protocols has created new economic opportunities and job roles within the digital economy. Artists, creators, developers, collectors, curators, and platform operators all contribute to the NFT ecosystem, fueling economic growth and innovation. NFT protocols provide the foundation for these economic activities, supporting the development of NFT marketplaces, applications, and infrastructure.

7. Cultural Preservation and Digital Collectibles: NFT protocols enable the preservation and monetization of digital cultural artifacts and collectibles. Historical artifacts, virtual real estate, virtual fashion items, and other digital collectibles can be tokenized and traded on NFT platforms. This opens up new avenues for preserving cultural heritage and monetizing digital creations that were previously difficult to value or monetize.

NFT liquidity protocols are vital for the economy as they establish standards and infrastructure for the creation, ownership, trading, and utilization of non-fungible tokens. They enable authenticity verification, secure ownership transfers, fractional ownership, secondary market trading, royalties, interoperability, and economic opportunities, shaping the landscape of the digital economy and unlocking new possibilities for creators, investors, and users alike.

Also read: Top 10 Benefits And Challenges For Selling NFTs For E-Commerce

Risk associated with NFT liquidity protocols

NFT liquidity protocols, also known as NFT lending or borrowing platforms, allow users to leverage their NFT holdings by borrowing against them or providing liquidity for others to borrow. While these protocols offer potential benefits, such as unlocking the value of illiquid NFT assets and providing additional avenues for earning income, they also come with certain risks. Here are some of the risks associated with NFT liquidity protocols:

1. Smart Contract Vulnerabilities: NFT liquidity protocols are built on smart contracts, which are subject to vulnerabilities and coding errors. If there are flaws in the smart contract code, it can be exploited by malicious actors, resulting in the loss or theft of NFT assets or funds locked in the protocol. Auditing the smart contracts and using reputable platforms that have undergone rigorous security assessments can help mitigate this risk.

2. Impermanent Loss: Impermanent loss is a risk that affects liquidity providers in decentralized exchanges or protocols. When providing liquidity for NFTs, the value of the underlying assets may fluctuate, causing a temporary loss when compared to simply holding the NFT. This risk arises due to the dynamic pricing of assets in the liquidity pool and can impact the overall profitability of participating in the protocol.

3. Counterparty Risk: NFT liquidity protocols involve interacting with other participants who borrow or provide liquidity. There is a risk that borrowers may default on their loans, resulting in a loss of funds for lenders. Similarly, liquidity providers may face the risk of fraudulent borrowers or platform insolvency. Conducting due diligence on borrowers, assessing their creditworthiness, and utilizing reputable platforms can help mitigate this risk to some extent.

4. Market Volatility: NFTs, like any other asset class, can be subject to significant price volatility. If the value of the underlying NFT collateral used for borrowing drops significantly, it can lead to liquidations and loss of collateral for borrowers. Lenders may also face a decrease in the value of the NFT collateral provided by borrowers, affecting the overall risk profile of the protocol. Monitoring market conditions and setting appropriate risk management mechanisms can help address this risk.

5. Regulatory and Legal Risks: The regulatory environment around NFTs is still evolving in many jurisdictions. NFT liquidity protocols may face regulatory scrutiny, which can lead to compliance challenges, restrictions, or potential shutdowns. Users should be aware of the legal and regulatory landscape in their jurisdiction and evaluate the associated risks and potential implications.

6. Lack of Standardization: The NFT ecosystem is still relatively new and lacks standardized protocols and practices. Different liquidity protocols may have varying terms, fees, and operational models, making it challenging for users to compare and assess the risks associated with each platform. Conducting thorough research, understanding the protocol’s mechanics, and seeking community feedback can help mitigate this risk.

7. Market and Demand Risk: The demand for NFTs can be subject to changing market trends, cultural shifts, or overall market sentiment. If the demand for certain types of NFTs declines significantly, it can impact the liquidity and value of assets held within the protocol. Users should be mindful of the evolving NFT market dynamics and assess the potential risks associated with specific NFT categories or assets.

It’s essential for users to understand these risks before participating in NFT liquidity protocols. Conducting thorough research, diversifying risk exposure, utilizing reputable platforms, and exercising caution can help mitigate some of these risks.

Also read: Here’s How the Dark Side of Web3 Gets Away With NFT Theft

Benefits of NFT liquidity protocols

NFT liquidity protocols, also known as NFT lending or borrowing platforms, offer several benefits to users. These protocols enable the monetization and utilization of illiquid NFT assets, providing new avenues for value creation and income generation. Here are some of the benefits of NFT liquidity protocols:

1. Unlocking Liquidity: NFTs are often illiquid assets, meaning they can be challenging to convert into cash or trade for other assets. NFT liquidity protocols allow users to unlock the value of their NFT holdings by leveraging them as collateral to borrow funds. This enables users to access immediate liquidity without needing to sell their NFTs outright.

2. Flexible Borrowing Options: NFT liquidity protocols offer flexible borrowing options, allowing users to tailor their borrowing needs according to their preferences. Users can choose the amount they want to borrow, the duration of the loan, and the interest rate they are willing to pay. This flexibility allows for customized financing solutions based on individual needs and financial goals.

3. Income Generation for NFT Holders: NFT liquidity protocols provide an opportunity for NFT holders to earn passive income by lending their NFT assets. Users can provide liquidity to the platform by locking their NFTs as collateral and earning interest on their holdings. This allows NFT holders to generate income from their assets while still maintaining ownership and exposure to potential future appreciation.

4. Diversification of Investment Portfolio: NFT liquidity protocols enable users to diversify their investment portfolio by utilizing their NFT assets as collateral for borrowing. By leveraging their NFTs, users can access funds to invest in other asset classes, participate in new projects, or seize investment opportunities that they may not have been able to access otherwise. This diversification can help manage risk and potentially enhance overall investment returns.

5. Speculation and Leverage: NFT liquidity protocols allow users to speculate and take leveraged positions on the value of NFT assets. Users can borrow funds against their NFT holdings and use those funds to acquire additional NFTs or invest in other assets. This leverage magnifies potential gains if the value of the NFTs appreciates. However, it’s important to note that leverage also amplifies potential losses, so users should exercise caution and carefully manage their risk exposure.

6. Community Engagement and Participation: NFT liquidity protocols often have vibrant communities of users who actively participate in borrowing, lending, and trading activities. These platforms can foster a sense of community and provide opportunities for networking, collaboration, and knowledge sharing among NFT enthusiasts and investors. Engaging with the community can offer valuable insights, exposure to new projects, and potential partnership opportunities.

7. Price Discovery and Valuation: NFT liquidity protocols can contribute to price discovery and the establishment of fair market values for NFT assets. As borrowing and lending activity takes place within the protocol, it generates data points and transactions that reflect the perceived value of NFTs. This data can be used to assess market trends, inform pricing decisions, and provide valuable insights for market participants.

It’s important for users to understand the specific terms, risks, and mechanics of each NFT liquidity protocol they engage with. While these protocols offer benefits, users should conduct thorough research, evaluate the associated risks, and carefully consider their individual financial goals and risk tolerance before participating.

Also read: Top 10 Ways NFTs Can Boost Your Passive Income

Top 10 NFT liquidity protocols of 2023

Non-fungible tokens (NFTs) have exploded in popularity in recent years, with sales reaching $25 billion in 2022. This growth has led to a demand for liquidity protocols that can help users buy and sell NFTs easily and efficiently.

Here are the top 10 NFT liquidity protocols of 2023:

- NFTX NFTX is a platform that creates liquid markets for NFTs by tokenizing them. This means that users can buy and sell NFTs on exchanges just like they would any other cryptocurrency.

- NiftyPays NiftyPays is a platform that allows users to buy and sell NFTs using their credit cards. This makes it easy for people who are new to NFTs to get started.

- NFT Trader NFT Trader is a platform that allows users to trade NFTs directly with each other. This can be a good option for people who want to avoid fees charged by exchanges.

- DODO DODO is a decentralized exchange that uses a novel algorithm to provide liquidity for NFTs. This algorithm is designed to be more efficient than traditional market makers, which can lead to lower fees for users.

- Boson Protocol Boson Protocol is a platform that allows users to buy and sell physical goods using NFTs. This can be used for things like buying concert tickets or clothes.

- Zora Zora is a platform that allows users to create and sell NFTs without any fees. This makes it a good option for artists and creators who want to sell their work without having to give up a cut to a platform.

- SuperFarm SuperFarm is a platform that allows users to farm NFTs. This means that users can earn NFTs by staking their tokens or completing tasks.

- Deri Deri is a platform that allows users to trade NFT derivatives. This means that users can bet on the future price of NFTs.

- Matry Matry is a platform that allows users to create and manage NFT collections. This can be used for things like creating trading cards or collectible items.

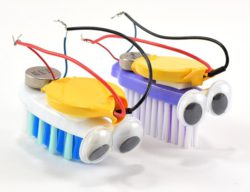

10. Bristlebot: This is a simple robot that can be made with a few materials, including a CD, a battery, and a toothbrush. The toothbrush bristles are used as the robot’s legs, and the CD provides the robot with a platform to move on.

10. Bristlebot: This is a simple robot that can be made with a few materials, including a CD, a battery, and a toothbrush. The toothbrush bristles are used as the robot’s legs, and the CD provides the robot with a platform to move on.

Future of NFT liquidity protocols

The future of NFT liquidity protocols is promising, as they continue to evolve and mature alongside the growing NFT market. Here are some key areas that may shape the future of NFT liquidity protocols:

1. Increased Market Adoption: As the NFT market expands and gains mainstream recognition, the adoption of NFT liquidity protocols is likely to increase. More users, including artists, collectors, and investors, are expected to leverage their NFT assets to unlock liquidity, generate income, and participate in borrowing and lending activities. This increased adoption will contribute to the growth and development of the ecosystem.

2. Interoperability and Cross-Chain Integration: Currently, NFT liquidity protocols primarily operate on specific blockchain networks, such as Ethereum. However, as interoperability solutions and cross-chain technologies advance, we can expect to see NFT liquidity protocols that span multiple blockchain networks. This interoperability will allow users to access liquidity across various platforms and tap into a broader range of NFT assets.

3. Enhanced Risk Management: Risk management will continue to be a critical focus for NFT liquidity protocols. Efforts will be made to improve risk assessment mechanisms, implement robust collateral valuation methodologies, and provide more transparent and accurate information to users. This will help mitigate risks associated with smart contract vulnerabilities, market volatility, and counterparty default.

4. Integration with DeFi Ecosystem: DeFi (Decentralized Finance) has gained significant traction in the blockchain space, and we can expect NFT liquidity protocols to integrate more closely with the DeFi ecosystem. This integration could involve collaboration with decentralized exchanges, yield farming opportunities, and composability with other DeFi protocols. Such integration will provide users with a broader range of financial services and enhance the overall functionality of NFT liquidity platforms.

5. Expansion of Asset Classes: While NFT liquidity protocols have predominantly focused on artwork and collectibles, we can anticipate the expansion into other asset classes. This could include tokenized real estate, virtual land, in-game items, digital identities, intellectual property rights, and more. The diversification of asset classes will attract a wider range of users and contribute to the overall growth and maturity of the NFT liquidity ecosystem.

6. Regulation and Compliance: With the increasing popularity of NFTs and the associated liquidity protocols, regulatory scrutiny is likely to intensify. Governments and regulatory bodies are likely to explore frameworks to address investor protection, anti-money laundering (AML), and Know Your Customer (KYC) requirements within the NFT space. Compliance with regulatory standards will become more important for NFT liquidity protocols to foster trust, attract institutional investors, and ensure long-term sustainability.

7. Improved User Experience: User experience enhancements will be a focal point for NFT liquidity protocols. Efforts will be made to simplify onboarding processes, streamline borrowing and lending mechanisms, and provide user-friendly interfaces. Additionally, advancements in user interfaces, decentralized identity solutions, and gas optimization techniques will improve the overall usability and accessibility of NFT liquidity protocols.

8. Integration of Oracles and Data Feeds: Reliable and accurate pricing data is crucial for NFT liquidity protocols. The integration of oracle services and data feeds will help provide up-to-date market prices, valuation models, and risk assessment tools. These external data sources will enhance the transparency and efficiency of NFT liquidity platforms and enable more accurate pricing and borrowing/lending decisions.

9. Governance and Decentralization: NFT liquidity protocols are likely to embrace greater decentralization and community governance models. Users may have the ability to participate in decision-making processes, such as protocol upgrades, fee structures, and risk parameters. This decentralized governance will ensure that the protocols align with the interests of the community and allow for continuous evolution and improvement.

10. Integration of Layer 2 Scaling Solutions: Scalability has been a challenge for blockchain networks like Ethereum, resulting in high gas fees and slower transaction times. NFT liquidity protocols may integrate with layer 2 scaling solutions, such as sidechains or second-layer protocols, to enhance scalability, reduce costs, and improve the overall efficiency of transactions within the protocols.

11. Enhanced Privacy Features: Privacy is a growing concern in the blockchain space. Future NFT liquidity protocols may introduce privacy-enhancing technologies, such as zero-knowledge proofs or secure multi-party computation, to protect sensitive information related to borrowing, lending, and asset ownership. These privacy features will ensure confidentiality while maintaining the transparency and immutability of the underlying blockchain.

12. Integration with Traditional Financial Systems: NFT liquidity protocols may bridge the gap between traditional finance and the blockchain space. Integration with traditional financial systems, such as banks or payment processors, may enable seamless fiat on-ramps/off-ramps, facilitate compliance with regulatory frameworks, and attract a wider range of users who are more familiar with traditional financial systems.

13. Improved Fractionalization Mechanisms: Fractionalization of NFTs allows for the creation of fractional ownership tokens, enabling broader investment opportunities. Future NFT liquidity protocols may enhance fractionalization mechanisms, making it easier for users to tokenize and trade fractional ownership in NFTs. This will democratize access to high-value assets and increase liquidity in the market.

14. NFT Collateralization for Traditional Loans: As the NFT market matures, NFT liquidity protocols may expand beyond borrowing and lending within their platforms. They could serve as collateral providers for traditional loans, where NFT assets can be used as collateral in the traditional lending ecosystem. This integration would provide additional liquidity options and bridge the gap between traditional finance and the NFT ecosystem.

15. Integration of Artificial Intelligence and Machine Learning: Future NFT liquidity protocols may leverage artificial intelligence (AI) and machine learning (ML) technologies to enhance risk assessment, automate processes, and optimize borrowing and lending strategies. AI/ML models could analyze market data, monitor borrower behavior, and provide personalized recommendations to optimize the borrowing and lending experience for users.

16. Cross-Protocol Integrations: NFT liquidity protocols may integrate with other DeFi protocols, such as lending platforms, decentralized exchanges, or yield farming platforms. This cross-protocol integration will provide users with a seamless experience, allowing them to leverage their NFT assets across multiple platforms and tap into a wide range of DeFi opportunities.

17. Sustainable Practices: Environmental concerns related to blockchain technology, particularly the energy consumption associated with certain consensus algorithms, have gained attention. Future NFT liquidity protocols may focus on adopting more sustainable practices, such as utilizing energy-efficient blockchains, implementing proof-of-stake consensus mechanisms, or offsetting carbon footprints through initiatives like carbon credits or renewable energy investments.

These points outline some potential directions for the future of NFT liquidity protocols. It’s important to note that the evolution of the NFT ecosystem is dynamic, and the actual trajectory of these protocols may vary based on technological advancements, market demands, regulatory developments, and user preferences.

Emerging NFT Financial Products

The conference showcased various new financial products centered around NFTs, such as NFT lending, OTC swap protocols, and NFT shorting.

These solutions address liquidity challenges, making the NFT market more accessible and versatile.

— Liisa (@liisa_io) June 13, 2023