What Is Spot Trading In The Crypto World And How Does It Work?

April 22, 2024 by Diana Ambolis

703

No Comments

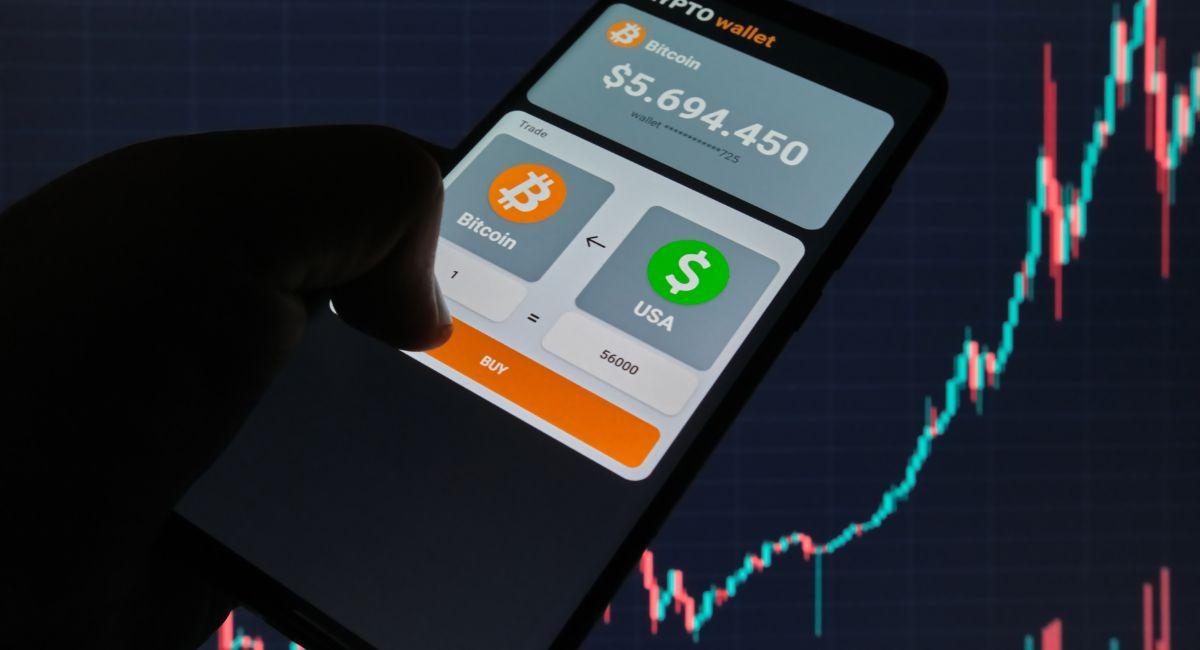

Spot trading in the cryptocurrency market is a form of trading where participants buy and sell actual cryptocurrencies, such as Bitcoin, Ethereum, or other digital assets, at the current market price. It involves the immediate exchange of assets, and the settlement occurs “on the spot,” meaning the transaction is settled instantly or within a short

Spot trading in the cryptocurrency market is a form of trading where participants buy and sell actual cryptocurrencies, such as Bitcoin, Ethereum, or other digital assets, at the current market price. It involves the immediate exchange of assets, and the settlement occurs “on the spot,” meaning the transaction is settled instantly or within a short period, typically within two business days.

Key Elements of Spot Trading:

- Immediate Settlement: In spot trading, the transaction is settled immediately or within a very short timeframe. Once a buyer and seller agree on the price, the assets are exchanged, and ownership is transferred. This is in contrast to futures or options trading, where the settlement can happen at a future date.

- Actual Ownership of Assets: Participants in spot trading physically own the cryptocurrencies they buy. The transactions involve the transfer of ownership of the digital assets from the seller’s wallet to the buyer’s wallet on the blockchain.

- Spot Market Exchanges: Spot trading occurs on spot market exchanges, where buyers and sellers interact directly to exchange cryptocurrencies. These exchanges provide a platform for users to place market orders, limit orders, and execute trades at the prevailing market prices.

- Market Price Determination: The prices in spot trading are determined by the supply and demand dynamics in the market. The current market price is the price at which the last transaction occurred. Spot traders buy or sell at these market prices or set limit orders at specific prices they are willing to accept.

- No Contractual Agreements: Spot trading does not involve contractual agreements for the future delivery of assets. Traders simply exchange the assets at the agreed-upon price without committing to a future date for settlement.

Spot trading in the cryptocurrency market is a direct and immediate exchange of digital assets, such as Bitcoin, Ethereum, or other cryptocurrencies, at the current market price. This form of trading involves the buying and selling of actual assets, and the settlement occurs instantly or within a short period, typically within two business days. Let’s explore in vast detail how spot trading works in the crypto space:

Steps in Spot Trading:

- Account Setup: Traders need to create an account on a cryptocurrency exchange that supports trading. They go through the necessary KYC (Know Your Customer) and account verification processes.

- Deposit Funds: Traders deposit funds into their exchange accounts. These funds are used to buy cryptocurrencies during spot trading.

- Market Analysis: Before making trades, participants typically analyze market conditions, using technical analysis, fundamental analysis, or a combination of both. They assess factors like price trends, market volumes, and relevant news.

- Placing Orders: Traders can place different types of orders, such as market orders or limit orders. A market order is executed immediately at the current market price, while a limit order is executed only when the price reaches a specified level set by the trader.

- Execution and Settlement: When a buyer and a seller agree on a price, the trade is executed. The cryptocurrency is transferred from the seller’s wallet to the buyer’s wallet, and the transaction is recorded on the blockchain. Settlement occurs promptly.

- Withdrawal or Holding: After a successful trade, traders can choose to withdraw their cryptocurrencies to external wallets for added security or hold them within the exchange for potential future trades.

Also, read- BitMart Offers Zero Fees for Makers On 200+ Class-A Spot Trading Pairs

Spot trading in the cryptocurrency market has both advantages and disadvantages that traders and investors should carefully consider. Understanding the pros and cons is crucial for making informed decisions in the dynamic and often volatile crypto environment.